Are you considering making the switch to solar energy and wondering how to finance your solar panel installation? Well, you're in the right place! In this guide, we'll explore everything you need to know about solar panel financing, from understanding the costs to exploring financing options in Tampa. Let's dive in!

Introduction to Solar Panel Financing

So, you've decided to go solar – congratulations! Investing in solar panels for your home is not only a great way to reduce your carbon footprint but also a smart financial decision in the long run. However, one of the biggest hurdles for many homeowners is figuring out how to finance the upfront costs of solar panel installation.

But don't worry, there are several financing options available that can make going solar more affordable and accessible. From government incentives and rebates to solar loans and leasing programs, there's a solution out there that can fit your budget and needs.

When it comes to solar panel financing, the key is to evaluate your financial situation, set a budget, and explore the different options available to you. By doing your research and understanding the costs and benefits of each financing method, you can make an informed decision that aligns with your goals and preferences.

Whether you're looking to save money on your electricity bills, increase the value of your home, or simply reduce your environmental impact, financing your solar panel installation is the first step towards achieving your renewable energy goals.

Now, let's break down the costs of solar panel installation and explore the various financing options available in Tampa to help you make the best choice for your home and budget.

Solar Panel Financing in Tampa: Understanding the Cost of Solar Panel Installation

So, you've decided to make the switch to solar energy and are excited about the prospect of reducing your carbon footprint while saving money on your energy bills. However, before you can start enjoying the benefits of solar power, it's important to understand the cost of solar panel installation in Tampa.

The cost of installing solar panels on your home can vary depending on several factors, including the size of your system, the type of panels you choose, and the complexity of the installation process. On average, the cost of installing a solar panel system in Tampa ranges from $10,000 to $25,000, with most homeowners paying around $15,000 for a standard 5kW system.

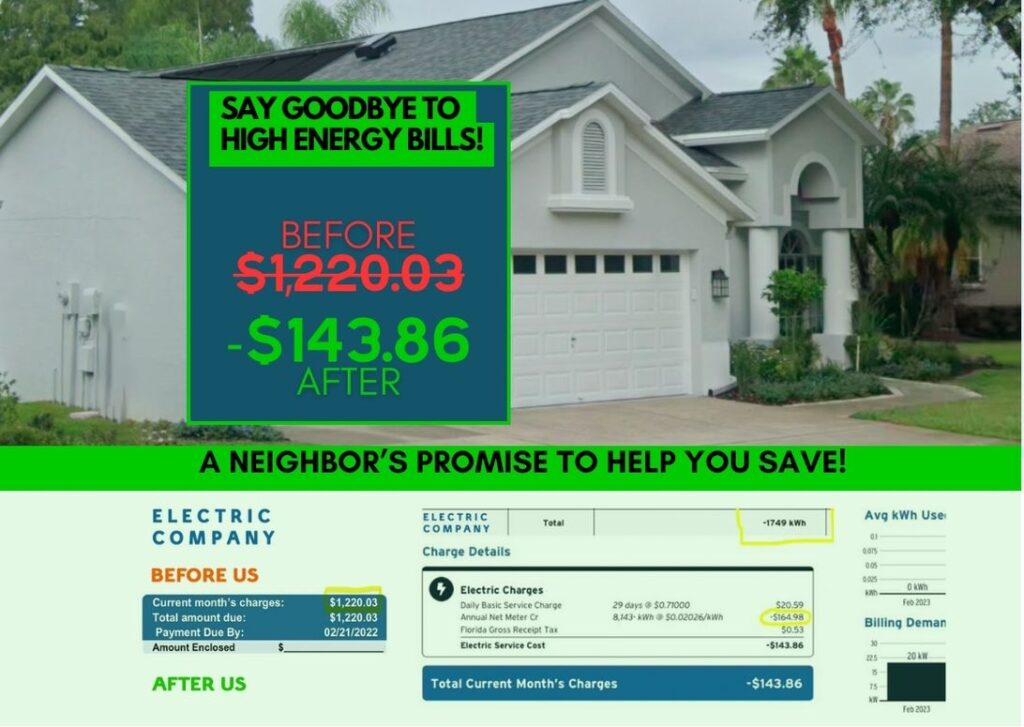

While this initial cost may seem high, it's important to remember that solar panels can pay for themselves over time through energy savings and government incentives. In fact, most homeowners in Tampa see a return on their investment within 5 to 7 years, with some even recouping their initial costs in as little as 3 years.

When calculating the cost of solar panel installation, it's essential to consider the long-term savings and benefits that come with going solar. By generating your own clean energy, you can significantly reduce your monthly electricity bills, protect yourself from rising energy costs, and increase the value of your home.

Additionally, installing solar panels can make you eligible for various government incentives and rebates that can help offset the upfront cost of installation. In Tampa, homeowners can take advantage of the federal Investment Tax Credit (ITC), which allows you to deduct 26% of the cost of your solar panel system from your federal taxes. There are also state and local incentives available, such as property tax exemptions and sales tax exemptions, that can further reduce the cost of going solar.

To ensure you get the most out of your solar panel investment, it's essential to work with a reputable solar panel installer in Tampa who can help you navigate the financing options available to you. Whether you choose to pay for your system upfront, finance it with a solar loan, or lease your panels through a third-party provider, a professional installer can guide you through the process and help you find the financing option that best suits your needs and budget.

In conclusion, while the cost of solar panel installation in Tampa may seem daunting, the long-term benefits of going solar far outweigh the initial investment. By understanding the cost of installation, exploring financing options, and taking advantage of government incentives, you can make the switch to solar energy with confidence and start enjoying the many benefits of clean, renewable power.

Understanding Financing Options for Solar Panels in Tampa

So, you've decided to take the leap and go solar in Tampa – congratulations! Now comes the exciting part of exploring the various financing options available to make your solar panel installation a reality. Let's dive into some key points to consider when looking for the best financing solution for your home.

1. **Solar Panel Leasing**: This option allows you to “rent” the solar panels from a solar company rather than purchasing them outright. While this can be a more affordable upfront cost, keep in mind that you won't own the panels and may miss out on potential savings in the long run. Leasing can be a good option for those who want to go green without a significant financial commitment.

2. **Solar Loans**: Another popular choice is to finance your solar panels through a solar loan. These loans are specifically designed for solar projects, often offering low-interest rates and flexible repayment terms. With a solar loan, you'll own the panels and can take advantage of any financial benefits they may bring, such as tax credits and reduced energy bills.

3. **Power Purchase Agreements (PPAs)**: With a PPA, a third-party company installs and maintains the solar panels on your property. In return, you agree to purchase the electricity generated by the panels at a set rate. While this can be a convenient option with little to no upfront cost, keep in mind that you won't own the panels and may not benefit from certain incentives.

4. **Home Equity Loan or Line of Credit**: If you have equity in your home, you may consider using a home equity loan or line of credit to finance your solar panel installation. This can be a cost-effective option, as interest rates on home equity loans tend to be lower than other financing options. Just be sure to factor in the potential impact on your home's value and consult with a financial advisor before making a decision.

5. **PACE Financing**: Property Assessed Clean Energy (PACE) programs allow homeowners to finance energy-efficient upgrades, including solar panels, through a special assessment on their property taxes. PACE financing can be a flexible option with no upfront costs, but it's important to understand the terms and conditions of the program before committing.

As you explore these financing options for solar panels in Tampa, remember to consider factors such as your budget, long-term savings goals, and overall financial strategy. It's also a good idea to research local incentives, rebates, and tax credits that may be available to help offset the cost of your solar panel installation.

By taking the time to understand and compare different financing options, you can make an informed decision that aligns with your energy goals and financial priorities. Happy solar panel shopping!

When it comes to installing solar panels in your home in Tampa, it's essential to consider the various government incentives and rebates available to help offset the initial cost. These incentives can make a significant difference in the overall cost of your solar panel installation, making it a more affordable and sustainable option for your energy needs.

One of the most significant incentives for solar panel installation is the Federal Investment Tax Credit (ITC). This credit allows you to deduct 26% of the cost of installing a solar energy system from your federal taxes. This can result in substantial savings and make the upfront costs of solar panel installation much more manageable.

Additionally, many states, including Florida, offer their own incentives and rebates for solar panel installation. In Florida, homeowners can take advantage of the Property Assessed Clean Energy (PACE) program, which allows you to finance your solar panel installation through a special assessment on your property taxes. This can help spread out the cost of solar panel installation over time, making it more affordable for homeowners.

Another incentive to consider is the net metering program, which allows homeowners with solar panels to earn credits for the excess energy their system generates and feeds back into the grid. These credits can then be used to offset your electricity bill, saving you even more money in the long run.

When exploring financing options for solar panels in Tampa, it's crucial to do your research and take advantage of all the incentives and rebates available to you. By leveraging these opportunities, you can make solar panel installation a cost-effective and environmentally friendly choice for your home.

In conclusion, government incentives and rebates play a crucial role in making solar panel installation more affordable for homeowners in Tampa. By taking advantage of programs like the Federal Investment Tax Credit, PACE, and net metering, you can significantly reduce the cost of solar panel installation and enjoy the many benefits of clean, renewable energy for your home.

So, you've made the decision to go solar – congratulations! Now comes the exciting part of figuring out how to finance your solar panel installation. One popular option that many homeowners in Tampa are considering is solar loans. Let's dive into what solar loans are all about and how they can help you make the switch to clean, renewable energy.

Financing Solar Panels with Solar Loans

When it comes to financing your solar panel system, solar loans are a fantastic option that can make the upfront costs more manageable. Essentially, a solar loan is a type of loan specifically designed to help homeowners purchase and install solar panels. These loans typically have lower interest rates than traditional loans, making them a cost-effective way to fund your solar project.

One of the key benefits of solar loans is that they allow you to own your solar panel system outright. This means that you can take advantage of all the financial incentives that come with solar ownership, such as tax credits and potential increases in property value. Additionally, owning your system allows you to reap the long-term savings on your electricity bills, as you won't have to pay a monthly lease fee like with solar leases.

How to Find the Right Solar Loan

When looking for a solar loan in Tampa, it's essential to shop around and compare offers from different lenders. Be sure to consider factors such as interest rates, loan terms, and any additional fees that may be associated with the loan. You'll want to choose a loan that fits your budget and offers favorable terms that will help you maximize your savings.

It's also a good idea to look for solar loans that offer flexible repayment options. Some lenders may allow you to choose between fixed or variable interest rates, as well as different loan terms. By selecting a loan that aligns with your financial goals and preferences, you can ensure that you're comfortable with your repayment plan and can enjoy the benefits of solar energy stress-free.

Benefits of Financing with Solar Loans

Opting for a solar loan to finance your solar panel installation comes with a range of benefits. Not only do you get to enjoy the financial incentives of solar ownership, but you also have the satisfaction of knowing that you're investing in a clean, sustainable energy source. By choosing a solar loan, you're taking a significant step towards reducing your carbon footprint and contributing to a greener future for Tampa and beyond.

So, if you're eager to make the switch to solar and want to take advantage of the many benefits that come with solar ownership, consider financing your solar panel installation with a solar loan. With the right loan, you can embark on your solar journey with confidence and start enjoying the perks of clean, renewable energy in no time.

Solar panel leasing is a popular option for homeowners in Tampa who want to enjoy the benefits of solar energy without the upfront costs of purchasing a system. When you lease solar panels, you essentially rent the system from a solar company that installs and maintains it on your property. This can be a great way to go solar without breaking the bank.

One of the main advantages of leasing solar panels is that you can start saving on your electricity bills immediately. With a fixed monthly lease payment, you can lock in lower electricity rates and potentially save money from day one. Additionally, since the solar company owns and maintains the system, you won't have to worry about maintenance or repair costs.

Another benefit of leasing solar panels is that you can go green without a large financial commitment. By choosing to lease, you can reduce your carbon footprint and contribute to a more sustainable future without having to make a significant investment upfront. This can be a great option for homeowners who are environmentally conscious but may not have the funds to purchase a solar system outright.

When considering leasing solar panels in Tampa, it's important to do your research and choose a reputable solar company with a good track record. Look for companies that offer competitive lease terms, transparent pricing, and high-quality solar panels. Be sure to read the lease agreement carefully and ask any questions you may have before signing on the dotted line.

Additionally, keep in mind that leasing may not be the best option for everyone. While it can be a cost-effective way to go solar, you won't be eligible for certain government incentives and tax credits that are available to homeowners who purchase a solar system. It's important to weigh the pros and cons of leasing versus purchasing to determine which option is best for your individual needs and financial situation.

In conclusion, leasing solar panels can be a convenient and affordable way to harness the power of the sun and reduce your reliance on traditional energy sources. By choosing to lease, you can enjoy the benefits of solar energy without the high upfront costs or maintenance responsibilities. Just be sure to do your due diligence, compare lease options, and work with a reputable solar company to ensure a smooth and successful solar panel installation process.

Solar panels are a fantastic investment for your home, providing clean energy and potentially saving you money in the long run. However, the upfront cost of installation can be a barrier for many homeowners. That's where financing options come in to make solar panel installation more accessible. Choosing the right financing option is crucial to ensure that you get the most out of your investment. Here are some tips for selecting the best solar panel financing option for your needs.

**1. Assess Your Financial Situation**

Before diving into the world of solar panel financing, take a close look at your financial situation. Consider factors such as your credit score, income, and existing debt. This will help you determine how much you can afford to pay upfront and how much you can comfortably pay back over time.

**2. Research Different Financing Options**

There are several ways to finance solar panel installation, including solar loans, leases, power purchase agreements (PPAs), and cash purchases. Each option has its pros and cons, so it's essential to research and compare them to find the best fit for your situation.

**3. Consider Government Incentives and Rebates**

Many governments offer incentives and rebates to homeowners who install solar panels. These can significantly reduce the upfront cost of installation, making solar panels more affordable. Be sure to look into what incentives are available in your area and factor them into your financing decision.

**4. Look for Low-Interest Loans**

If you opt for a solar loan, shop around for the best interest rates. Lower interest rates can save you money in the long run, so it's worth taking the time to find a loan with favorable terms. Some lenders specialize in solar financing and may offer competitive rates.

**5. Compare Leasing Options**

Leasing can be a good option for homeowners who don't want to pay upfront for solar panels. However, be sure to compare lease terms, including monthly payments, escalator clauses, and buyout options. Make sure you understand all the terms and conditions before signing a lease agreement.

**6. Choose a Reputable Solar Panel Financing Provider**

When selecting a financing option, it's crucial to work with a reputable provider. Look for companies with a track record of success in the solar industry and read reviews from other customers. A trustworthy provider will guide you through the financing process and ensure that you make the best decision for your home.

**7. Consult with Solar Experts**

If you're unsure about which financing option is right for you, don't hesitate to consult with solar experts. They can provide valuable insights and help you navigate the complexities of solar panel financing. Experts can also help you calculate your potential savings and ROI, giving you a clear picture of the benefits of going solar.

By following these tips, you can make an informed decision about financing your solar panel installation in Tampa. With the right financing option, you can start enjoying the benefits of clean, renewable energy while saving money on your electricity bills. So, take the time to research, compare, and consult with experts to ensure that you choose the best financing option for your home.