Understanding Solar Panel Financing Options

Are you considering installing solar panels in your Tampa home but unsure about how to finance this sustainable energy investment? Well, you're in luck! Understanding solar panel financing options can make the process smoother and more affordable for you. Let's dive into the different ways you can finance your solar panel system.

1. Cash Purchase: The most straightforward option is to pay for your solar panels upfront with cash. While this may require a significant initial investment, it can provide you with the quickest return on investment through energy savings and potentially increase the value of your home.

2. Solar Loans: If you don't have the cash on hand, solar loans are a popular option. These loans are specifically designed for solar panel installations and offer competitive interest rates, making them a cost-effective way to finance your system while still reaping the benefits of solar energy.

3. Solar Leases: With a solar lease, you can enjoy the benefits of solar energy without the upfront costs. Instead of owning the system, you pay a fixed monthly fee to lease the panels from a third-party provider. While you won't own the system, you can still save on your electricity bills.

4. Power Purchase Agreements (PPAs): PPAs are similar to solar leases but involve paying for the electricity generated by the solar panels rather than the panels themselves. This can be a great option for homeowners who want to go solar without any upfront costs.

5. Home Equity Loans: If you have equity in your home, you can use a home equity loan or line of credit to finance your solar panel installation. These loans typically have lower interest rates than personal loans, making them a cost-effective option for homeowners looking to invest in solar energy.

6. Property Assessed Clean Energy (PACE) Financing: PACE financing allows homeowners to finance their solar panels through an assessment on their property taxes. This option can be appealing for homeowners who want to spread out the cost of their solar panels over time.

By understanding these solar panel financing options, you can choose the one that best fits your budget and lifestyle. Whether you prefer to pay upfront, take out a loan, or explore lease options, there is a financing solution that can help you go solar in Tampa. Stay tuned for more insights on the benefits of financing solar panels and how to maximize your savings with this eco-friendly investment.

II. Benefits of Financing Solar Panels in Tampa

Are you considering installing solar panels in your Tampa home but unsure about the financial aspect? Let's delve into the benefits of financing solar panels in Tampa and why it might be the perfect choice for you.

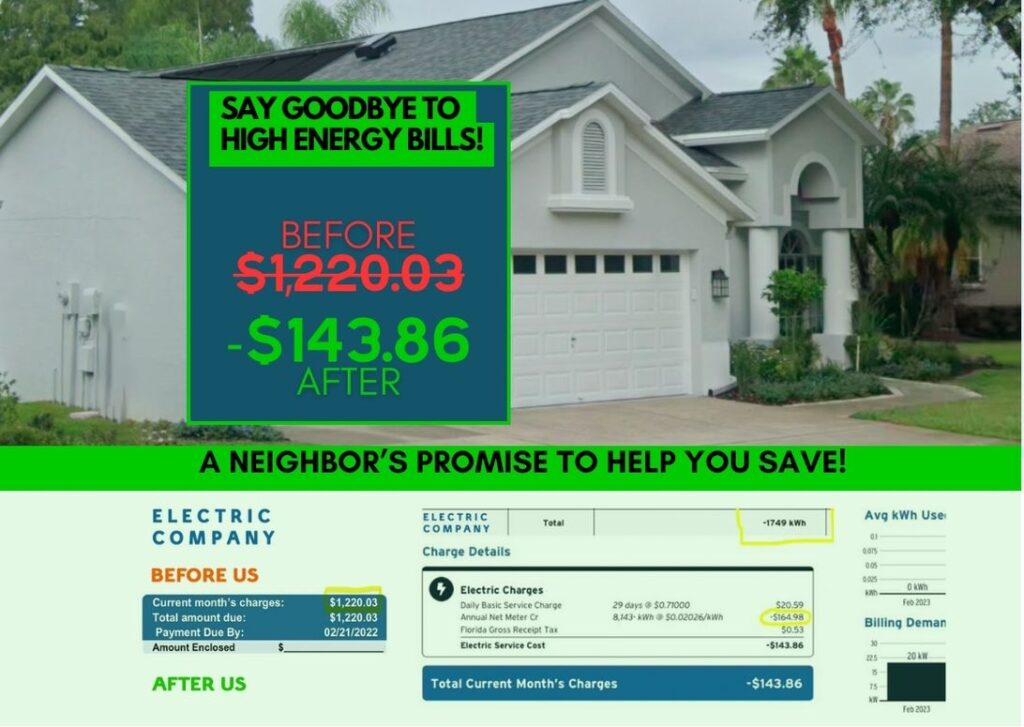

1. **Cost-Effective**: One of the primary benefits of financing solar panels in Tampa is the cost-effectiveness it offers. By spreading out the upfront cost of solar panel installation over a period of time, you can start saving on your energy bills from day one. With Tampa's abundant sunshine, you can generate your electricity and significantly reduce your monthly utility expenses.

2. **Increased Home Value**: Investing in solar panels can increase the value of your home. Potential buyers are increasingly looking for energy-efficient homes, and solar panels can be a major selling point. In Tampa's competitive real estate market, having solar panels can set your home apart and attract more buyers.

3. **Environmental Impact**: By financing solar panels in Tampa, you are not only saving money but also contributing to a cleaner environment. Solar energy is a renewable resource that reduces your carbon footprint and helps combat climate change. With Tampa's commitment to sustainability, installing solar panels aligns with the city's green initiatives.

4. **Federal and State Incentives**: Tampa residents can take advantage of federal and state incentives for solar panel installation. Tax credits, rebates, and other financial incentives make financing solar panels even more attractive. These incentives can offset a significant portion of the installation cost, making solar energy more accessible to homeowners.

5. **Energy Independence**: With solar panels, you can become more energy independent and self-sufficient. Instead of relying solely on the grid, you can generate your electricity, reducing your dependence on traditional energy sources. In Tampa, where hurricanes and storms can disrupt power supply, solar panels provide a reliable backup power source.

6. **Long-Term Savings**: While the initial investment in solar panels may seem daunting, the long-term savings are well worth it. Over time, you can recoup the cost of installation through reduced energy bills and potential income from selling excess energy back to the grid. With financing options, you can start saving money immediately without a substantial upfront payment.

In conclusion, financing solar panels in Tampa offers a multitude of benefits, from cost-effectiveness and increased home value to environmental impact and energy independence. By taking advantage of federal and state incentives and exploring financing options, you can make the switch to solar energy a seamless and rewarding experience for your home. So, why wait? Start reaping the benefits of solar panels in Tampa today!

III. Federal and State Incentives for Solar Panel Installation

When considering the installation of solar panels on your home in Tampa, it's essential to explore the various federal and state incentives available to help offset the initial costs. These incentives can significantly reduce the financial burden of transitioning to solar energy and make it a more attractive option for many homeowners.

One of the most well-known federal incentives is the Federal Investment Tax Credit (ITC). This credit allows homeowners to deduct a percentage of the cost of installing a solar energy system from their federal taxes. Currently, the ITC offers a 26% credit for systems installed in 2022, but it is set to decrease in the coming years. Therefore, it's crucial to take advantage of this incentive while it's still available at a higher rate.

In addition to the federal ITC, Florida offers its own state-level incentives for solar panel installation. The state of Florida has a property tax exemption for residential solar energy systems, which means that homeowners won't see an increase in their property taxes due to the added value of the solar panels. This exemption can result in significant savings over the lifetime of the solar energy system.

Furthermore, Florida also has a sales tax exemption for solar energy systems, making it more cost-effective for homeowners to purchase and install solar panels. By leveraging both federal and state incentives, homeowners in Tampa can make the switch to solar energy more affordable and environmentally friendly.

It's important to note that these incentives are subject to change, so it's crucial to stay informed about the latest updates and deadlines to maximize your savings. Consulting with a reputable solar panel provider can also help you navigate the complex landscape of incentives and ensure that you're taking full advantage of all available programs.

By understanding and utilizing federal and state incentives for solar panel installation, homeowners in Tampa can make a smart investment in renewable energy that not only benefits the environment but also their wallets in the long run. So, don't miss out on these valuable incentives and start reaping the rewards of solar energy today!

IV. Choosing the Right Financing Plan for Your Home

When it comes to financing solar panels for your home, there are several options available to choose from. It can be overwhelming to navigate through the various plans and find the one that best suits your needs. Here are some tips to help you select the right financing plan for your home:

1. **Assess Your Budget:** Before diving into the world of solar panel financing, it's essential to evaluate your budget. Determine how much you are willing to invest in solar panels and how much you can afford to pay monthly. This will give you a clear idea of what financing options are feasible for you.

2. **Research Different Financing Options:** There are several financing plans available for solar panels, such as solar loans, solar leases, power purchase agreements (PPAs), and solar PACE programs. Each option comes with its own set of benefits and considerations. Take the time to research and understand the pros and cons of each before making a decision.

3. **Consider Tax Incentives and Rebates:** Federal and state governments offer various incentives, tax credits, and rebates to homeowners who install solar panels. These incentives can significantly reduce the overall cost of your solar panel system. Make sure to take these into account when choosing a financing plan.

4. **Evaluate the Length of the Financing Term:** Some financing plans may require you to commit to a long-term agreement, while others offer more flexibility. Consider your future plans for your home and how long you are willing to commit to a financing plan before making a decision.

5. **Compare Interest Rates and Fees:** Different financing options come with varying interest rates and fees. Make sure to compare these aspects to ensure you are getting the best deal possible. Look for low-interest rates and minimal fees to save money in the long run.

6. **Seek Professional Advice:** If you are unsure about which financing plan is best for your home, don't hesitate to seek advice from a solar panel expert or financial advisor. They can provide you with valuable insights and help you make an informed decision.

By following these tips, you can choose the right financing plan for your home and enjoy the benefits of solar panels for years to come. Remember, investing in solar panels is not only beneficial for the environment but also for your wallet in the long term. Make a smart choice today and start your journey towards a more sustainable future with solar energy.

## Steps to Qualify for Solar Panel Financing

So, you've decided to take the plunge and invest in solar panels for your home in Tampa. Congratulations on making a smart choice for the environment and your wallet! Now, you might be wondering how you can qualify for financing to make this dream a reality. Don't worry; I've got you covered with some simple steps to help you navigate the process smoothly.

### Step 1: Check Your Credit Score

One of the first things lenders will look at when considering your application for solar panel financing is your credit score. A good credit score not only helps you qualify for better financing options but also demonstrates your reliability as a borrower. You can easily check your credit score for free online and take steps to improve it if needed before applying for financing.

### Step 2: Assess Your Debt-to-Income Ratio

Lenders will also evaluate your debt-to-income ratio to determine your ability to repay the loan. This ratio compares your monthly debt payments to your monthly income. Ideally, your debt payments should not exceed a certain percentage of your income. By reducing your existing debt or increasing your income, you can improve your chances of qualifying for favorable financing terms.

### Step 3: Research Financing Options

Before applying for solar panel financing, take the time to research different lenders and financing options available to you. Compare interest rates, terms, and incentives offered by various financial institutions to find the best fit for your needs. Some lenders specialize in solar panel financing and may offer competitive rates and flexible terms tailored to renewable energy projects.

### Step 4: Gather Necessary Documents

To streamline the financing process, gather all necessary documents, such as proof of income, tax returns, bank statements, and any other financial documents required by the lender. Having these documents ready will help expedite the application process and demonstrate your preparedness as a borrower.

### Step 5: Submit Your Application

Once you've done your homework, improved your credit score, assessed your debt-to-income ratio, and gathered the necessary documents, it's time to submit your financing application. Be prepared to answer any questions the lender may have about your financial situation and provide any additional information requested promptly.

### Step 6: Review and Accept Terms

After submitting your application, carefully review the terms and conditions of the financing offer. Pay close attention to the interest rate, repayment schedule, and any incentives or rebates available to you. If everything looks good, accept the offer and start planning for the installation of your solar panels.

By following these steps, you can increase your chances of qualifying for solar panel financing and make your transition to renewable energy a seamless and rewarding experience. Remember, investing in solar panels not only benefits the environment but also saves you money in the long run. Good luck on your solar panel journey!

VI. Common Misconceptions about Financing Solar Panels

So, you're considering going solar, but you might have heard some myths or misconceptions that are making you hesitant. Let's debunk some of these common misconceptions about financing solar panels to help you make an informed decision:

1. **”Solar panels are too expensive to install.”**

While it's true that solar panel installation can have a significant upfront cost, there are various financing options available that can make it more affordable. Many lenders offer low-interest loans, and there are leasing and power purchase agreement (PPA) options that require little to no money down. With the federal and state incentives available, you can recoup your investment quicker than you might think.

2. **”Solar panels require a lot of maintenance.”**

Actually, solar panels are quite low maintenance. They have no moving parts, so there's little that can go wrong. Typically, all you need to do is keep them clean by rinsing them off a few times a year, and they'll keep generating clean, renewable energy for your home.

3. **”Solar panels only work in sunny climates.”**

While it's true that solar panels perform best in sunny climates, they can still generate power on cloudy days. Solar panels can even produce electricity on overcast days, albeit at a reduced rate. So, even if you live in a region with less sunlight, solar panels can still be a viable option for you.

4. **”Solar panels will damage my roof.”**

This is a common concern, but reputable solar installation companies take great care to ensure that your roof remains intact. In fact, solar panels can actually protect your roof by providing an extra layer of insulation and shielding it from the elements. Plus, solar panels are designed to be lightweight and easy to install without causing damage.

5. **”Solar panels are only for homeowners.”**

While it's true that owning your home makes it easier to install solar panels, there are options for renters and those who can't install panels on their property. Community solar programs allow you to invest in a shared solar installation and receive credits on your electricity bill. Additionally, some states offer incentives for renters to go solar, making it accessible to a wider range of people.

By debunking these misconceptions, you can see that financing solar panels is a smart investment in the long run. With the right financing plan and incentives, you can save money on your energy bills, reduce your carbon footprint, and increase the value of your home. Don't let misinformation hold you back from enjoying the benefits of solar energy – take the first step towards a greener future today!

Solar Panel Financing: Tips for Maximizing Savings

So, you've decided to take the plunge and invest in solar panels for your home. Congratulations on making a smart choice for both your wallet and the environment! Now, let's talk about how you can maximize your savings through smart financing strategies. Here are some tips to help you get the most out of your solar panel investment:

1. **Research Federal and State Incentives**: Before you commit to a financing plan, make sure you explore all the federal and state incentives available for solar panel installation. These incentives can significantly reduce the upfront cost of your system and make financing more affordable in the long run.

2. **Compare Financing Options**: Don't settle for the first financing plan you come across. Take the time to compare different options, including solar loans, leases, and power purchase agreements. Look for a plan that offers the best terms and lowest interest rates to maximize your savings.

3. **Consider Solar Tax Credits**: The federal government offers a solar investment tax credit (ITC) that allows you to deduct a percentage of the cost of your solar panel system from your taxes. This can result in significant savings and make financing more cost-effective.

4. **Opt for Energy-Efficient Appliances**: To further maximize your savings, consider investing in energy-efficient appliances that can complement your solar panel system. By reducing your overall energy consumption, you can lower your electricity bills and increase your return on investment.

5. **Monitor Your Energy Usage**: Keep track of your energy usage before and after installing solar panels. By monitoring your consumption patterns, you can adjust your habits to maximize the benefits of your solar panel system and save even more money on your energy bills.

6. **Maintain Your Solar Panels**: Regular maintenance is key to ensuring your solar panels operate at peak efficiency. By keeping your panels clean and well-maintained, you can maximize their performance and prolong their lifespan, ultimately saving you money in the long run.

7. **Educate Yourself**: The more you know about solar panel financing and energy efficiency, the better equipped you'll be to make informed decisions that maximize your savings. Take the time to educate yourself on the latest trends, technologies, and incentives in the solar industry to stay ahead of the curve.

By following these tips and leveraging the available incentives and financing options, you can maximize your savings and enjoy a more sustainable and cost-effective energy solution for your home. Remember, investing in solar panels is not just about saving money – it's also about making a positive impact on the planet. So, go ahead and make the switch to solar today!