Understanding Solar Panel Financing Options

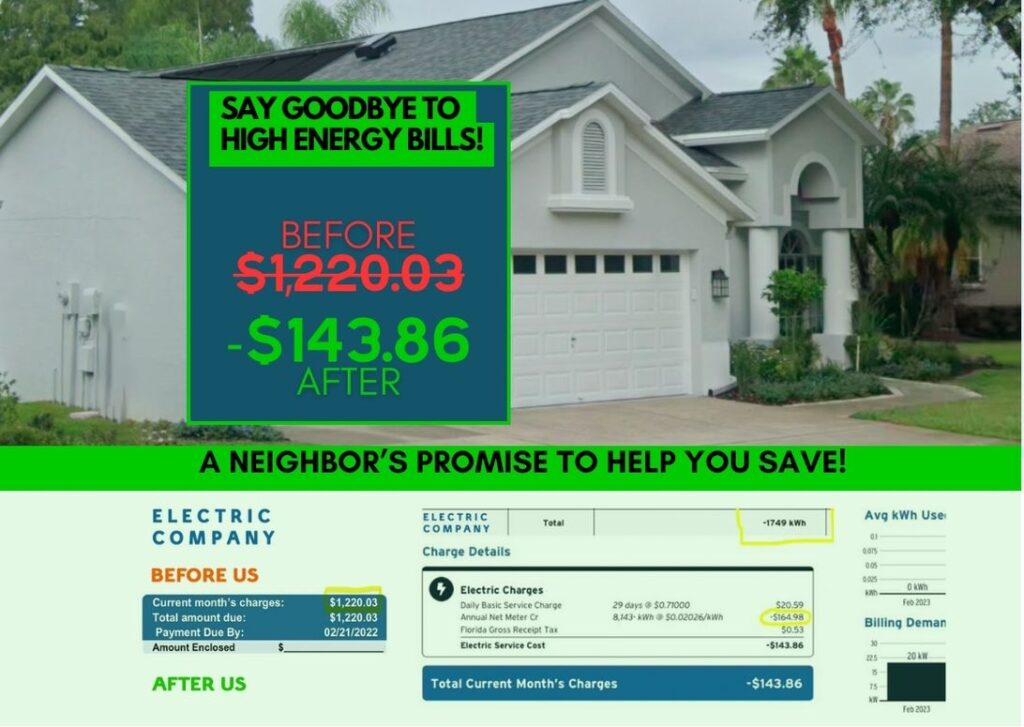

So, you're considering making the switch to solar energy for your home in Tampa – that's fantastic news! Not only will you be reducing your carbon footprint, but you'll also be saving money on your electricity bills in the long run. However, the upfront costs of installing solar panels can be a deterrent for many homeowners. That's where solar panel financing options come into play.

When it comes to financing your solar panel system, you have several choices to consider. One popular option is a solar loan, where you borrow money from a lender to pay for the installation of your solar panels. These loans typically have competitive interest rates and flexible repayment terms, making them a great choice for many homeowners.

Another financing option is a solar lease, where you essentially rent the solar panels from a third-party provider. While you won't own the panels with a lease, you can still benefit from reduced electricity bills and potentially lower upfront costs. However, it's essential to carefully review the terms of the lease to ensure it makes financial sense for you in the long run.

If you're looking to take advantage of federal and state incentives for solar, financing your system with a solar loan may be the best option. Many states, including Florida, offer tax credits, rebates, and other incentives to help offset the cost of installing solar panels. By financing your system with a loan, you can still benefit from these incentives while spreading out the cost over time.

Before making any decisions, it's crucial to research local Tampa financing programs that may be available to you. Many local governments and utility companies offer financing options, rebates, and other incentives to encourage homeowners to switch to solar energy. By taking advantage of these programs, you can make solar energy more affordable for your home.

When comparing loans vs. leases for solar panel installation, be sure to consider the return on investment (ROI) of each option. While a lease may have lower upfront costs, owning your solar panel system outright with a loan can lead to greater long-term savings. Calculate the potential savings and payback period for each option to determine which makes the most financial sense for your situation.

In conclusion, understanding your solar panel financing options is crucial when considering a switch to solar energy for your home in Tampa. By exploring federal and state incentives, researching local financing programs, and comparing loans vs. leases, you can make an informed decision that benefits both your wallet and the environment. Stay tuned for more tips on securing affordable financing and working with professional solar panel installers in Tampa to make your solar energy dreams a reality.

Exploring Federal and State Incentives for Solar

So, you're thinking about going solar? That's fantastic! Not only will you be reducing your carbon footprint and saving money on your energy bills, but you may also be eligible for some pretty sweet incentives from the government. Let's dive into the world of federal and state incentives for solar panels and see how you can make the most out of your investment.

Federal Incentives

The federal government has some great incentives in place to encourage homeowners to go solar. The Investment Tax Credit (ITC) allows you to deduct a percentage of the cost of your solar panel system from your federal taxes. Currently, the ITC is set at 26% of the total cost of your system, but it's important to note that this percentage is set to decrease in the coming years. So, the time to act is now!

Another federal incentive to consider is the Residential Renewable Energy Tax Credit. This credit allows you to claim a certain percentage of the cost of your solar panel system as a tax credit, further reducing the overall cost of your investment.

State Incentives

On top of federal incentives, many states offer their own incentives to homeowners who go solar. These can include rebates, tax credits, or performance-based incentives that pay you for the electricity your system produces. The specifics of state incentives vary depending on where you live, so it's important to do your research and see what's available in your area.

For those of you living in Tampa, Florida, you're in luck! The Sunshine State is known for its abundant sunshine, making it the perfect place to harness solar energy. Florida offers property tax exemptions for residential solar installations, as well as sales tax exemptions on the purchase of solar energy equipment. Additionally, some utility companies in Florida offer rebates or incentives for going solar, so be sure to check with your local utility provider.

Maximizing Your Incentives

By taking advantage of both federal and state incentives, you can significantly reduce the upfront cost of installing a solar panel system. This means a quicker return on your investment and more savings in the long run. So, don't leave money on the table – explore all the incentives available to you and make the most out of your switch to solar!

Remember, going solar is not only good for the environment, but it's also a smart financial decision. With the right incentives in place, you can make the transition to solar energy more affordable and accessible than ever before. So, what are you waiting for? Start exploring your options and see how you can start saving with solar today!

Researching Local Tampa Financing Programs

Are you considering installing solar panels on your home in Tampa, but feeling overwhelmed by the financial aspect of it all? Don't worry, you're not alone! Many homeowners are eager to embrace renewable energy but are unsure about how to finance the upfront costs. Luckily, there are several financing options available, especially at the local level in Tampa.

1. Tampa Electric Solar Loan Program

One great option to explore is the Tampa Electric Solar Loan Program. This program offers low-interest loans to homeowners looking to install solar panels on their property. These loans can help cover the initial costs of purchasing and installing solar panels, making it more affordable for you to go solar. Be sure to check out the terms and conditions of the loan to see if it fits your financial situation.

2. Hillsborough County Property Assessed Clean Energy (PACE) Program

Another financing option to consider is the Hillsborough County PACE Program. PACE programs allow homeowners to finance energy-efficient home improvements, such as solar panel installations, through a special assessment on their property taxes. This can be a convenient way to spread out the cost of going solar over time, making it more budget-friendly for many homeowners.

3. Solar Energy Loan Fund (SELF)

The Solar Energy Loan Fund (SELF) is a non-profit organization that provides low-interest loans for energy-efficient home improvements, including solar panel installations. SELF offers flexible repayment terms and competitive interest rates, making it a great option for homeowners looking to go solar without breaking the bank. Check out their website to see if you qualify for a loan.

By researching and exploring these local financing programs in Tampa, you can find a solution that works best for your financial situation. Remember, going solar is an investment in your home's energy future, and these financing options can make it more accessible for you.

When researching local financing programs, be sure to compare interest rates, repayment terms, and eligibility requirements to find the best fit for your needs. You may also want to consult with a solar energy expert or financial advisor to get personalized advice on the right financing option for you.

In conclusion, don't let the upfront costs of solar panel installation deter you from making the switch to renewable energy. With the help of local financing programs in Tampa, you can make your dream of going solar a reality. Start researching today and take the first step towards a more sustainable and energy-efficient home!

Installing solar panels in your home is a smart move towards sustainable living and saving on energy costs in the long run. But before diving into the installation process, it's crucial to weigh the options when it comes to financing your solar panel system. There are two main routes to consider: loans or leases.

1. **Loans**: Opting for a solar panel loan means borrowing money to cover the upfront costs of purchasing and installing solar panels on your property. These loans can be obtained from banks, credit unions, or specialized solar financing companies. When choosing a loan, consider the interest rate, repayment terms, and any additional fees involved.

– **Benefits**:

– **Ownership**: With a loan, you own the solar panels and can benefit from any tax incentives or rebates available.

– **Increased Home Value**: Solar panels can boost your home's value, potentially offering a return on investment when you sell.

– **Tax Benefits**: Depending on your location, you may be eligible for tax credits or incentives for installing solar panels.

– **Considerations**:

– **Credit Score**: Lenders may require a good credit score to qualify for a solar panel loan.

– **Monthly Payments**: Make sure you can comfortably afford the monthly payments before committing to a loan.

– **Interest Rates**: Compare interest rates from different lenders to secure the best deal.

2. **Leases**: Alternatively, you can opt for a solar panel lease where a third-party company installs and maintains the panels on your property. In exchange, you pay a fixed monthly fee for the energy generated by the solar panels. While this option requires less upfront investment, you won't own the panels or benefit from tax incentives.

– **Benefits**:

– **Low Upfront Costs**: Leases require minimal upfront costs, making solar energy more accessible.

– **Maintenance**: The leasing company is responsible for maintaining and repairing the solar panels.

– **Fixed Payments**: Monthly lease payments are predictable, making budgeting easier.

– **Considerations**:

– **Ownership**: You won't own the solar panels or benefit from potential increases in home value.

– **Long-Term Costs**: Over time, leasing may cost more than purchasing solar panels outright.

– **Terms and Conditions**: Carefully review the lease agreement to understand your obligations and limitations.

When deciding between a loan and a lease for your solar panel installation, consider your financial situation, long-term goals, and energy needs. Evaluate the pros and cons of each option to determine the best fit for your home and budget. Consult with solar panel experts and financial advisors to make an informed decision that aligns with your sustainability goals and financial objectives. By weighing the benefits and considerations of loans versus leases, you can embark on your solar journey confidently and make a choice that suits your needs.

Solar panels are undoubtedly a smart investment for your home, not only for the environment but also for your wallet. One crucial aspect to consider when contemplating solar panel installation is the Return on Investment (ROI). Calculating the ROI of solar panels can help you understand how long it will take to recoup your initial investment and start saving money on energy bills.

To determine the ROI of solar panels, you need to consider various factors such as the cost of installation, available incentives, energy savings, and the lifespan of the solar panels. Let's break it down further:

1. **Cost of Installation**: The initial cost of purchasing and installing solar panels can vary depending on the size of your system, the brand of panels, and any additional equipment needed. While the upfront cost may seem significant, remember that there are financing options available to make it more affordable.

2. **Available Incentives**: Federal and state governments often offer incentives, such as tax credits or rebates, to encourage homeowners to switch to solar energy. These incentives can significantly reduce the overall cost of installation and improve the ROI of solar panels.

3. **Energy Savings**: One of the most significant benefits of solar panels is the savings you'll see on your energy bills. By generating your electricity, you can reduce or even eliminate your reliance on the grid, resulting in lower monthly expenses.

4. **Lifespan of Solar Panels**: Solar panels are known for their durability and long lifespan, typically ranging from 25 to 30 years. This longevity ensures that you'll continue to benefit from energy savings long after you've recouped your initial investment.

To calculate the ROI of solar panels, you can use a simple formula: (Total Savings – Total Costs) / Total Costs x 100. This calculation will give you a percentage that represents how long it will take to pay off your investment through energy savings.

Keep in mind that the ROI of solar panels can vary based on factors like your location, energy consumption, and the cost of electricity in your area. Additionally, working with a reputable solar panel installer in Tampa can help you accurately assess your ROI and choose the best system for your home.

Ultimately, investing in solar panels is not just about the financial return but also about reducing your carbon footprint and contributing to a more sustainable future. By understanding the ROI of solar panels and taking advantage of available incentives, you can make an informed decision that benefits both your finances and the environment. So, don't hesitate to explore solar panel installation options and start enjoying the many benefits of renewable energy.

Solar panels are an excellent investment for homeowners looking to save money on their energy bills while also reducing their carbon footprint. However, the upfront cost of installing solar panels can be a barrier for many people. That's where affordable financing options come into play. Here are some tips for securing affordable financing for solar panels in Tampa:

1. **Research Loan Options:** When it comes to financing solar panels, loans are a popular choice for many homeowners. There are various types of loans available, including solar-specific loans, home equity loans, and personal loans. Research different loan options to find the one that best suits your financial situation.

2. **Check for Incentives:** In addition to financing options, there are also federal and state incentives available for installing solar panels. These incentives can help offset the cost of installation and make solar panels more affordable. Make sure to explore all available incentives before making a decision.

3. **Compare Interest Rates:** When applying for a loan to finance your solar panel installation, it's essential to compare interest rates from different lenders. Look for lenders that offer competitive rates and favorable terms to ensure you're getting the best deal possible.

4. **Consider Leasing:** Another financing option to consider is leasing. With a solar lease, you can rent the solar panels from a company and pay a monthly fee for using them. While leasing may not offer the same long-term benefits as purchasing solar panels, it can be a more affordable option for homeowners with limited upfront capital.

5. **Evaluate the ROI:** Before committing to financing solar panels, it's crucial to evaluate the return on investment (ROI). Calculate how much money you can save on your energy bills with solar panels and compare it to the cost of installation and financing. This will help you determine if investing in solar panels is a financially sound decision for you.

6. **Work with Professional Installers:** To ensure you're getting the most out of your investment in solar panels, it's essential to work with professional installers in Tampa. Look for reputable companies with experience in solar panel installation and a track record of satisfied customers. Professional installers can help you navigate the financing process and ensure your solar panels are installed correctly for optimal performance.

Securing affordable financing for solar panels doesn't have to be a daunting task. By researching loan options, checking for incentives, comparing interest rates, considering leasing, evaluating the ROI, and working with professional installers, you can make the process more manageable and cost-effective. With the right financing in place, you'll be well on your way to enjoying the benefits of clean, renewable energy from your solar panels.

Working with Professional Solar Panel Installers in Tampa

When it comes to installing solar panels in your home, one of the most crucial decisions you'll make is choosing the right professional solar panel installer in Tampa. Working with experienced and reputable installers can make a significant difference in the performance and longevity of your solar panel system.

Here are some valuable tips to help you find and work with the best solar panel installers in Tampa:

1. Research and Check Reviews: Start by researching local solar panel installers in Tampa and check their online reviews. Look for installers with a solid track record of successful installations and satisfied customers.

2. Ask for Recommendations: Reach out to friends, family, and neighbors who have already installed solar panels in their homes. They can provide valuable insights and recommendations on reputable installers in the area.

3. Get Multiple Quotes: Don't settle for the first installer you come across. It's essential to get multiple quotes from different installers to compare pricing, services, and warranties. This will help you make an informed decision.

4. Verify Licenses and Certifications: Ensure that the installer you choose is licensed, bonded, and insured. Also, check if they have certifications from reputable organizations like the North American Board of Certified Energy Practitioners (NABCEP).

5. Ask About Experience: Inquire about the installer's experience in the solar industry. Experienced installers are more likely to provide quality workmanship and reliable services.

6. Discuss Financing Options: A reputable solar panel installer will offer flexible financing options to make solar installation more accessible to homeowners. Make sure to discuss financing plans and incentives available for your solar project.

7. Evaluate Customer Service: Pay attention to how the installer communicates with you and addresses your questions and concerns. Excellent customer service is a crucial aspect of a successful solar panel installation.

8. Check Warranty Coverage: Inquire about the warranty coverage provided by the installer for your solar panel system. A reliable warranty ensures that your investment is protected in case of any issues.

9. Schedule a Consultation: Once you've narrowed down your choices, schedule a consultation with the installer to discuss your solar project in detail. This will give you a better sense of their professionalism and expertise.

10. Follow Up on Maintenance Services: Inquire about the maintenance services offered by the installer to ensure that your solar panel system remains efficient and functional in the long run.

By following these tips and working with professional solar panel installers in Tampa, you can ensure a smooth and successful solar panel installation process. Investing in solar energy is not only beneficial for the environment but also for your wallet in the long term. So, take the time to find the right installer who can help you harness the power of the sun for your home.