Are you considering installing solar panels in your home in Tampa? If so, you're on the right track towards a more sustainable and cost-effective energy solution. Solar panels offer numerous benefits that make them a worthwhile investment for homeowners looking to reduce their energy bills and carbon footprint. Let's dive into the advantages of solar panels in Tampa and why they are a smart choice for your home.

1. Lower Energy Bills

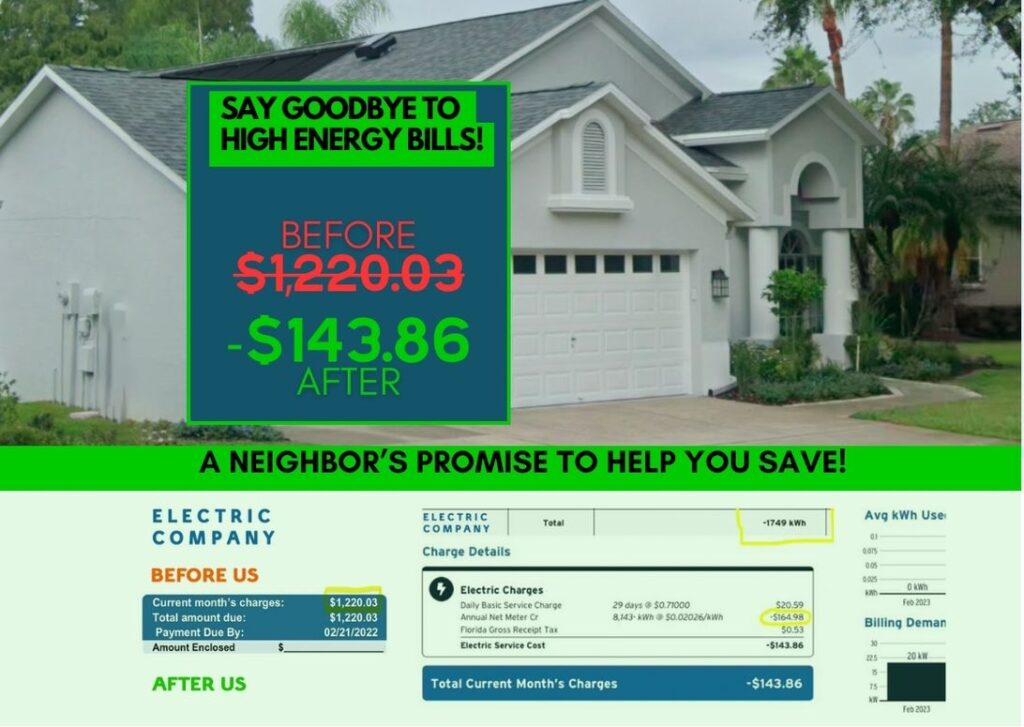

One of the most significant benefits of installing solar panels is the potential for substantial savings on your energy bills. By harnessing the power of the sun to generate electricity for your home, you can reduce or even eliminate your reliance on traditional utility companies. With ample sunshine in Tampa, you can generate enough solar power to cover a significant portion of your energy needs, leading to lower monthly bills and long-term savings.

2. Environmental Benefits

Switching to solar energy is not only beneficial for your wallet but also for the environment. Solar panels produce clean, renewable energy that reduces your carbon footprint and helps combat climate change. By generating electricity from the sun's rays, you can decrease your reliance on fossil fuels and contribute to a cleaner, greener future for Tampa and beyond.

3. Energy Independence

With solar panels powering your home, you gain a level of energy independence that provides peace of mind during power outages or disruptions. By generating your electricity on-site, you are less vulnerable to fluctuations in utility prices and grid failures. Solar panels offer a reliable and secure source of energy that keeps your home powered when you need it most.

4. Increased Home Value

Installing solar panels can also increase the value of your home. Studies have shown that homes with solar panels sell faster and at a higher price than those without. Potential buyers are attracted to the prospect of lower energy bills, eco-friendly features, and energy independence that solar panels offer. By investing in solar energy, you not only enjoy the benefits while you live in your home but also reap the rewards when it comes time to sell.

5. Rebates and Incentives

In addition to the long-term savings and environmental benefits, there are various rebates and incentives available to homeowners in Tampa who install solar panels. Federal and state programs offer financial incentives, tax credits, and rebates that can significantly reduce the upfront costs of solar panel installation. Taking advantage of these incentives makes solar panels even more affordable and attractive for homeowners looking to go solar.

In conclusion, the benefits of installing solar panels in Tampa are clear. From lower energy bills and environmental advantages to increased home value and energy independence, solar panels offer a multitude of advantages for homeowners. By harnessing the power of the sun, you can enjoy a sustainable and cost-effective energy solution that benefits both your wallet and the planet.

So, you've decided to take the leap and invest in solar panels for your home in Tampa. Congratulations! This decision not only benefits the environment but also offers long-term savings on your energy bills. Now, the next step is figuring out how to finance this eco-friendly upgrade. Let's explore some different financing options for solar panels that could make this transition smooth and affordable.

Exploring Different Financing Options for Solar Panels

When it comes to financing your solar panel system, there are several options to consider. Here are some popular choices:

- Cash Purchase: The most straightforward option is to pay for your solar panels upfront with cash. While this may require a larger initial investment, it can provide the quickest return on investment through energy savings.

- Solar Loans: Many financial institutions offer loans specifically for solar panel installations. These loans typically have low-interest rates and flexible repayment terms, making them a popular choice for homeowners looking to go solar without breaking the bank.

- Leasing: If you don't want to commit to purchasing solar panels outright, leasing could be a viable option. With a solar lease, you pay a fixed monthly fee to use the solar panel system on your property. While you may not be eligible for certain incentives, leasing can still provide savings on your energy bills.

- Power Purchase Agreements (PPAs): With a PPA, a third-party company installs solar panels on your property at no upfront cost. You then purchase the electricity generated by the panels at a fixed rate, typically lower than traditional utility rates. This allows you to enjoy the benefits of solar energy without the burden of ownership.

Each financing option has its own set of pros and cons, so it's essential to evaluate your financial situation and goals before making a decision. Consider factors like upfront costs, long-term savings, tax incentives, and maintenance responsibilities when choosing the right financing plan for your solar panels.

Remember, investing in solar panels is a long-term decision that can benefit both your wallet and the environment. By exploring different financing options and finding the right fit for your needs, you can make the switch to solar energy with confidence and ease.

Exploring Federal and State Incentives for Installing Solar Panels

When considering installing solar panels in your home in Tampa, it's essential to explore the various federal and state incentives available to help offset the initial costs. These incentives are designed to encourage homeowners to switch to renewable energy sources like solar power, making it more affordable and accessible for everyone.

Federal Incentives:

- Solar Investment Tax Credit (ITC): One of the most significant incentives offered by the federal government is the Solar Investment Tax Credit (ITC). This credit allows you to deduct a percentage of the cost of installing a solar energy system from your federal taxes. Currently, the ITC provides a 26% tax credit for systems installed in 2022. However, this percentage is set to decrease in the coming years, so it's essential to take advantage of it while you can.

- Net Metering: Net metering allows you to sell excess energy generated by your solar panels back to the grid. This means that you can earn credits on your electricity bill for the energy you produce but don't use. It's a great way to offset the cost of your investment and maximize the benefits of your solar panels.

State Incentives:

- Property Tax Exemption: Many states, including Florida, offer property tax exemptions for homeowners who install solar panels. This exemption means that the added value of your solar energy system will not increase your property taxes, making it a more financially attractive investment.

- Solar Rebates: Some states also offer cash rebates to homeowners who install solar panels. These rebates can help reduce the upfront costs of your solar energy system, making it more affordable in the long run.

By taking advantage of these federal and state incentives, you can significantly reduce the cost of installing solar panels in your home. It's essential to research and understand the incentives available to you, as they can vary depending on your location and the type of system you choose. Consulting with a professional solar panel installer in Tampa can also help you navigate the incentives and ensure you maximize your savings.

IV. Financing Your Solar Panels Through Loans and Leases

So, you've made the decision to go solar and reap the many benefits it offers. Now comes the question of how to finance your solar panel system. Don't worry; there are various options available to help you make this investment in a way that suits your financial situation. Let's delve into the world of loans and leases for solar panels.

1. **Solar Loans:** One popular option for financing your solar panels is through a solar loan. These loans are specifically designed for solar projects and often come with lower interest rates than conventional loans. With a solar loan, you can spread the cost of your solar panel system over several years, making it more affordable in the long run. Plus, as you repay the loan, you'll also be reaping the benefits of lower energy bills from your solar panels.

2. **Leasing:** Another option to consider is leasing your solar panels. With a solar lease, you essentially rent the solar panel system from a provider who installs and maintains it on your property. While you won't own the system, you can still enjoy the benefits of lower energy bills and potentially save money compared to your current utility costs. Leasing can be a good option if you don't want to deal with the upfront costs of purchasing a solar system.

3. **PPAs (Power Purchase Agreements):** A third financing option to explore is a Power Purchase Agreement (PPA). With a PPA, a third-party provider installs and maintains the solar panels on your property. In return, you agree to purchase the power generated by the system at a predetermined rate. This can be a cost-effective way to go solar without having to worry about maintenance or upfront costs.

4. **Consider the Long-Term Savings:** When deciding between a loan and a lease, consider the long-term savings each option offers. While a lease may require lower upfront costs, owning the system through a loan can provide greater savings over time. Be sure to calculate the total cost of each option, including any incentives or rebates, to determine which financing method is best for you.

5. **Consult with Solar Financing Experts:** To make an informed decision about financing your solar panels, it's a good idea to consult with solar financing experts. They can help you navigate the various options available, calculate potential savings, and find a financing plan that aligns with your budget and goals.

In conclusion, whether you choose a solar loan, lease, or PPA, financing your solar panel system is a smart investment that can pay off in the long run. By exploring different financing options and consulting with experts, you can make the transition to solar power a smooth and cost-effective process.

In the world of solar panels, evaluating the return on investment is crucial. You want to ensure that your investment in solar panels will pay off in the long run, both financially and environmentally. Let's dive into some tips for finding the right financing plan for your solar panels that will maximize your ROI.

**1. Understand Your Energy Consumption**: Before diving into financing options, it's essential to understand your current energy consumption. Take a look at your past energy bills to gauge how much electricity you use on average. This information will help you determine the size of the solar panel system you need to cover your energy needs.

**2. Consider Upfront Costs vs. Long-Term Savings**: When evaluating financing options for solar panels, consider the upfront costs versus the long-term savings. While purchasing solar panels outright may require a higher initial investment, it can result in greater savings over time compared to leasing or financing options.

**3. Explore Federal and State Incentives**: Look into federal and state incentives for installing solar panels. These incentives, such as tax credits and rebates, can help offset the cost of installation and improve your ROI. Be sure to check what incentives are available in Tampa to take advantage of these savings.

**4. Compare Loans and Leases**: When evaluating financing options, compare loans and leases to determine which option aligns best with your financial goals. Loans may require a higher upfront cost but can result in overall savings in the long run, while leases offer lower upfront costs but may have limitations on savings potential.

**5. Evaluate ROI Calculations**: Work with a solar panel installer to evaluate ROI calculations for different financing options. They can help you analyze projected savings, payback periods, and overall return on investment to make an informed decision that aligns with your budget and energy goals.

**6. Consider Maintenance and Warranty**: Factor in maintenance costs and warranty coverage when evaluating financing options. Some financing plans may include maintenance services and extended warranties, which can provide added value and peace of mind for your solar panel system.

**7. Work with Trusted Installers**: Lastly, work with trusted solar panel installers in Tampa who have a proven track record of quality installations and customer satisfaction. A reputable installer can help guide you through the financing process, answer any questions you may have, and ensure a smooth installation experience.

By following these tips for finding the right financing plan for your solar panels, you can make a well-informed decision that maximizes your ROI and sets you on the path to energy independence. Remember, investing in solar panels is not just about saving money – it's also about creating a sustainable future for generations to come.

As you embark on the exciting journey of installing solar panels in your home in Tampa, finding the right financing plan is crucial to ensuring a smooth and successful transition to renewable energy. There are various options available to make this investment more accessible and budget-friendly for homeowners. Here are some tips to help you find the right financing plan for your solar panels:

1. **Assess Your Budget**: Before diving into the world of solar panel financing, it's essential to evaluate your budget and determine how much you can comfortably invest in this renewable energy project. Consider your current financial situation, including any existing loans or debt, to establish a realistic budget for your solar panel installation.

2. **Research Different Financing Options**: There are several financing options available for installing solar panels, including solar loans, leases, power purchase agreements (PPAs), and incentives like tax credits and rebates. Take the time to research each option and compare their benefits and drawbacks to find the best fit for your financial goals and preferences.

3. **Consider the Return on Investment**: When evaluating financing plans for your solar panels, consider the return on investment (ROI) you can expect from this renewable energy upgrade. Calculate the potential savings on your energy bills, the increase in your home's value, and any incentives or tax credits you may be eligible for to determine the long-term benefits of going solar.

4. **Consult with Solar Panel Installers**: Work closely with trusted solar panel installers in Tampa to get expert advice on the best financing options for your specific needs. Experienced installers can help you navigate the complexities of solar panel financing and guide you towards the most cost-effective solution for your home.

5. **Look for Federal and State Incentives**: Take advantage of federal and state incentives for installing solar panels, such as the federal Investment Tax Credit (ITC) and state-specific rebates and incentives. These financial incentives can significantly reduce the upfront costs of going solar and make it more affordable for homeowners.

6. **Review Financing Terms and Conditions**: Before finalizing a financing plan for your solar panels, carefully review the terms and conditions of the agreement to ensure you understand the repayment terms, interest rates, and any additional fees involved. Be sure to ask questions and seek clarification on any aspects of the financing plan that are unclear to avoid any surprises down the road.

By following these tips and taking the time to find the right financing plan for your solar panels, you can make a smart and informed decision that aligns with your financial goals and contributes to a more sustainable future. With the help of trusted solar panel installers in Tampa and a well-thought-out financing strategy, you can enjoy the numerous benefits of solar energy while minimizing the financial burden of this eco-friendly upgrade.

Working with Trusted Solar Panel Installers in Tampa

When it comes to installing solar panels in your home, choosing the right solar panel installer is crucial. You want to work with a trusted and reputable company that has experience in the industry and can provide quality service from start to finish.

Here are some tips to help you find the best solar panel installer in Tampa:

1. Do Your Research: Take the time to research different solar panel installers in the Tampa area. Look for companies with positive reviews, certifications, and a proven track record of successful installations. You can also ask for recommendations from friends, family, or neighbors who have already installed solar panels.

2. Check Credentials: Make sure the solar panel installer you choose is licensed and insured. This will protect you in case of any accidents or damages during the installation process. Additionally, certifications from reputable organizations like the North American Board of Certified Energy Practitioners (NABCEP) can indicate that the installer meets high industry standards.

3. Ask About Experience: Inquire about the installer's experience with solar panel installations. An experienced installer will have the knowledge and skills to handle any challenges that may arise during the installation process.

4. Get Multiple Quotes: It's always a good idea to get quotes from multiple solar panel installers before making a decision. This will give you a better idea of the pricing and services offered by different companies, allowing you to make an informed choice.

5. Look for Warranty and Support: A reliable solar panel installer will offer warranties on both the equipment and the installation work. Make sure to ask about the warranty coverage and any after-sales support services provided by the company.

6. Consider Customer Service: Communication is key when working with a solar panel installer. Choose a company that is responsive, transparent, and willing to answer any questions you may have throughout the installation process.

By following these tips and working with a trusted solar panel installer in Tampa, you can ensure a smooth and successful installation of your solar panel system. Investing in solar energy not only benefits the environment but also saves you money on your electricity bills in the long run. So, take the time to find a reputable installer who will help you harness the power of the sun for your home.