Are you considering installing solar panels in your home in Tampa, but unsure about the financing options available to you? Look no further! In this guide, we will explore the various solar financing options in Tampa to help you make an informed decision. Let's dive in!

Solar panels have become a popular choice for homeowners looking to reduce their carbon footprint and save money on their energy bills. If you're considering installing solar panels in your home in Tampa, it's essential to understand the benefits of financing options available to you. Let's take a closer look at why financing solar panels could be a smart move for you.

Benefits of Financing Solar Panels

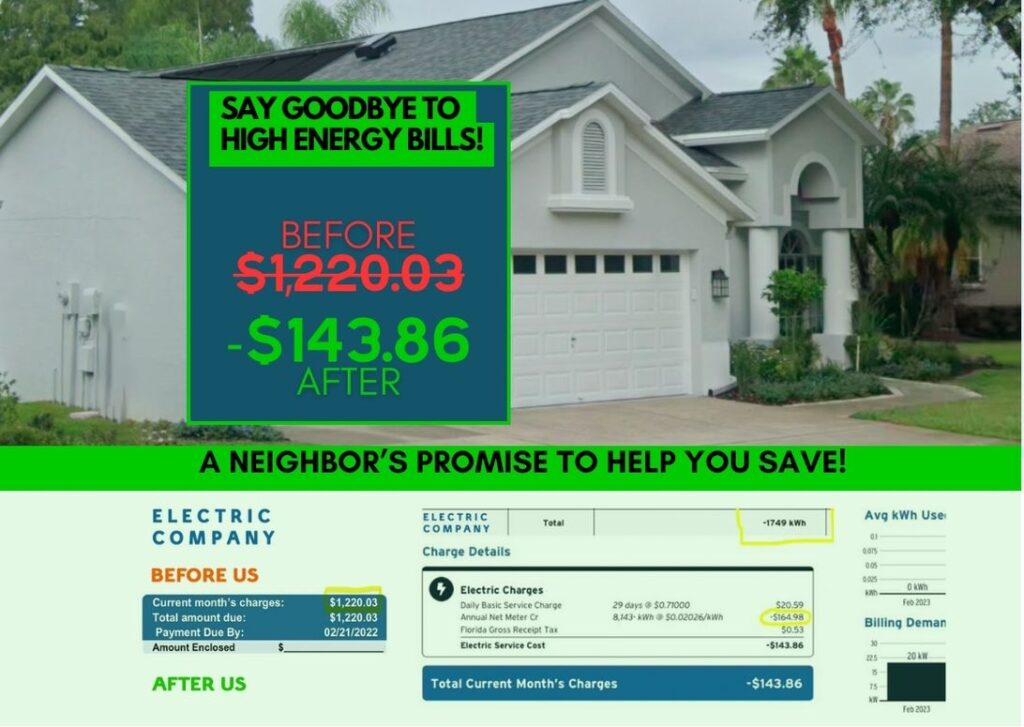

One of the main advantages of financing solar panels is that it allows you to enjoy the benefits of solar energy without having to pay the full cost upfront. By spreading out the cost over time, you can start saving on your electricity bills from day one, making solar energy more accessible and affordable for many homeowners.

Financing options also often come with tax incentives and rebates that can help offset the initial investment, making solar panels even more cost-effective in the long run. Additionally, financing allows you to lock in your energy costs, protecting you from rising utility rates and providing stability for your budget.

Moreover, investing in solar panels can increase the value of your home and make it more attractive to potential buyers in the future. This means that not only will you benefit from lower energy bills while you live in your home, but you'll also see a return on your investment when it comes time to sell.

Lastly, by choosing to finance your solar panels, you're making a positive impact on the environment by reducing your carbon footprint and reliance on fossil fuels. It's a win-win situation for both you and the planet.

Types of Solar Financing Options Available in Tampa

When it comes to financing your solar panel system in Tampa, you have several options to choose from. Each option has its own pros and cons, so it's important to understand the different types of financing available to make an informed decision that suits your financial situation and needs.

1. Solar Loans

Solar loans are a popular choice for homeowners who want to own their solar panels outright. With a solar loan, you can borrow money to pay for the system and then repay the loan over time. This option allows you to take advantage of federal and state incentives, such as tax credits and rebates, while enjoying the benefits of owning your solar panels.

2. Solar Lease

A solar lease is another option for homeowners who want to go solar without the upfront costs of purchasing a system. With a solar lease, you pay a monthly fee to lease the solar panels from a third-party provider. While you won't own the system, you can still benefit from lower electricity bills and potentially save money over time.

3. Power Purchase Agreement (PPA)

A Power Purchase Agreement (PPA) is a contract between you and a solar provider where you agree to purchase the electricity generated by the solar panels on your roof at a predetermined rate. This option allows you to enjoy the benefits of solar energy without any upfront costs, as the solar provider installs and maintains the system. PPAs are a great option for homeowners who want to save on electricity bills without the hassle of ownership.

4. Home Equity Line of Credit (HELOC)

If you have equity in your home, you can consider using a Home Equity Line of Credit (HELOC) to finance your solar panel system. A HELOC allows you to borrow against the equity in your home at a lower interest rate than other financing options. This can be a cost-effective way to finance your solar panels while leveraging the value of your home.

5. Property Assessed Clean Energy (PACE) Financing

PACE financing is a unique financing option that allows homeowners to finance energy-efficient home improvements, including solar panels, through a special assessment on their property taxes. With PACE financing, you can spread out the cost of your solar panels over time and repay the financing through your property tax bill. This option can be a convenient way to finance your solar panels without affecting your credit score.

Each of these financing options has its own advantages and considerations, so it's important to carefully evaluate your financial situation and goals before choosing the best option for you. By understanding the types of solar financing available in Tampa, you can make an informed decision that aligns with your budget and energy needs.

Factors to Consider When Choosing a Financing Plan

When it comes to investing in solar panels for your home in Tampa, choosing the right financing plan is crucial. With various options available, it's essential to consider a few key factors before making a decision. Here are some important considerations to keep in mind:

- Interest Rates: One of the primary factors to consider is the interest rate associated with the financing plan. Lower interest rates can save you money in the long run, so be sure to compare rates from different lenders before committing.

- Loan Terms: Understanding the terms of the loan is essential. Consider the length of the loan, monthly payments, and any additional fees or penalties. Choose a loan term that aligns with your financial goals and budget.

- Incentives and Rebates: Look for financing options that offer incentives or rebates for installing solar panels. These can help offset the initial costs and make solar more affordable for you.

- Flexibility: Consider how flexible the financing plan is. Can you make extra payments or pay off the loan early without penalties? Flexibility can provide you with peace of mind and financial freedom.

- Customer Service: A reliable customer service team can make a significant difference in your experience. Choose a lender that offers excellent customer support and is willing to address any concerns or questions you may have.

By carefully weighing these factors and conducting thorough research, you can select a financing plan that suits your needs and allows you to reap the benefits of solar energy without breaking the bank. Remember, investing in solar panels is not only a smart financial decision but also a sustainable choice for the environment.

Comparison of Different Financing Options

When it comes to financing your solar panel system in Tampa, it's essential to explore the various options available to find the best fit for your needs. Let's dive into a comparison of different financing options to help you make an informed decision:

Solar Loans

– Description: Solar loans are a popular choice for homeowners looking to purchase a solar panel system without paying the full cost upfront.

– Benefits: With solar loans, you can spread out the cost of your system over time while still enjoying the long-term savings on your energy bills.

– Considerations: Make sure to compare interest rates, loan terms, and any additional fees to find the most affordable option.

Solar Leases

– Description: With a solar lease, you can “rent” a solar panel system for a fixed monthly payment.

– Benefits: Solar leases require little to no upfront costs, making solar energy accessible to more homeowners.

– Considerations: Be aware of any escalator clauses in the lease agreement that could increase your monthly payments over time.

Power Purchase Agreements (PPAs)

– Description: A PPA allows you to purchase the electricity generated by a solar panel system installed on your property at a lower rate than your utility company.

– Benefits: PPAs offer a way to save on your electricity bills without the need to own the solar panels.

– Considerations: Understand the terms of the PPA, including the price per kilowatt-hour and the contract length.

Energy-Efficient Mortgages (EEMs):

– Description: EEMs are mortgage loans that include the cost of energy-efficient upgrades, such as solar panels, in the total loan amount.

– Benefits: EEMs can help finance your solar panel system while potentially increasing the value of your home.

– Considerations: Check with lenders to see if they offer EEMs and compare terms to traditional mortgage loans.

By comparing these different financing options, you can determine which one aligns best with your financial goals and preferences. Consider factors such as upfront costs, interest rates, contract terms, and long-term savings to make an informed decision.

Remember, it's always a good idea to consult with a solar energy expert or financial advisor to help you navigate the process and choose the right financing option for your solar panel system in Tampa. With the right financing in place, you'll be well on your way to enjoying the benefits of clean, renewable energy while saving money on your electricity bills.

So, you've decided to take the plunge and switch to solar energy for your home in Tampa. Congratulations on making a sustainable choice that benefits both the environment and your wallet in the long run! Now, let's talk about how you can qualify for solar financing to make this transition smoother and more affordable for you.

How to Qualify for Solar Financing in Tampa

When it comes to qualifying for solar financing in Tampa, there are a few key factors to consider. Here's what you need to know:

- Credit Score: One of the first things lenders will look at when considering you for solar financing is your credit score. A good credit score can help you secure better loan terms and interest rates. If your credit score is lower, don't worry! There are still options available for you, such as FHA loans or PACE financing.

- Income: Lenders will also take into account your income to ensure that you can afford the monthly payments on your solar loan. If you have a stable income and can show that you have the financial capacity to repay the loan, you are more likely to qualify for financing.

- Home Equity: Having equity in your home can make it easier to qualify for solar financing, as it gives lenders more security in case you default on the loan. If you have a good amount of equity in your home, you may be able to secure a home equity loan or line of credit to finance your solar panels.

- Debt-to-Income Ratio: Lenders will also look at your debt-to-income ratio, which is the percentage of your income that goes towards paying off debt. A lower debt-to-income ratio shows lenders that you have the capacity to take on additional debt, such as a solar loan.

- Property Assessment: Some financing options, like PACE financing, require a property assessment to determine the energy efficiency improvements needed in your home. This assessment will help determine the amount of financing you qualify for based on the potential energy savings from installing solar panels.

By understanding these key factors and taking steps to improve your credit score, increase your income, build home equity, and lower your debt-to-income ratio, you can improve your chances of qualifying for solar financing in Tampa. Remember, each financing option has its own requirements, so it's essential to explore all your options and find the best fit for your financial situation.

An introduction to solar energy

Welcome to the final step in your journey towards harnessing the power of solar energy for your home in Tampa! You've learned about the benefits of solar panels, explored the various financing options available, and now it's time to take action. In this section, we'll discuss what comes next after choosing the right solar financing plan for you.

Next Steps

Now that you've selected a solar financing option that fits your budget and preferences, it's time to move forward with the installation process. The next steps may vary depending on the financing plan you've chosen, but here are some general guidelines to help you navigate the process smoothly:

1. Contact Your Chosen Solar Provider: Reach out to the solar company you've selected to discuss the next steps. They will guide you through the installation process and provide you with a timeline for when you can expect your solar panels to be up and running.

2. Schedule a Site Visit: Most solar companies will conduct a site visit to assess your home's suitability for solar panel installation. During this visit, they will evaluate your roof's condition, orientation, and shading to determine the best placement for your solar panels.

3. Sign the Contract: Once the site visit is complete, you'll need to sign a contract with the solar company. This contract will outline the terms of the agreement, including the installation timeline, warranty information, and any other relevant details.

4. Permitting and Installation: The solar company will handle the permitting process on your behalf, ensuring that your solar panel system meets all local regulations. Once the permits are approved, the installation process can begin. Depending on the size of your system, installation typically takes a few days to complete.

5. Monitor Your System: Once your solar panels are installed, it's essential to monitor your system's performance regularly. Many solar companies offer monitoring services that allow you to track your system's energy production and ensure it's operating at peak efficiency.

6. Enjoy the Benefits of Solar: Congratulations! You've made the switch to clean, renewable energy. Now it's time to sit back, relax, and enjoy the many benefits of solar power, including reduced energy bills, increased home value, and a smaller carbon footprint.

By following these next steps, you'll be well on your way to reaping the rewards of solar energy in your Tampa home. If you have any questions or need further assistance along the way, don't hesitate to reach out to your solar provider for guidance. Happy solar panel installation!