Solar Incentives: Making Going Solar Even More Rewarding

Are you considering making the switch to solar energy for your home? Not only is solar power environmentally friendly, but it can also lead to significant savings on your energy bills in the long run. However, the upfront costs of installing solar panels can be a deterrent for some homeowners. Luckily, there are various incentives available to help offset these costs and make going solar even more appealing.

Federal Solar Incentives

The federal government offers several incentives to encourage the adoption of solar energy. One of the most well-known programs is the Federal Investment Tax Credit (ITC). This incentive allows you to deduct a percentage of the cost of your solar panel system from your federal taxes. Currently, the ITC allows for a 26% tax credit for systems installed in 2022. It's important to note that the percentage will decrease in the coming years, so now is a great time to take advantage of this opportunity.

In addition to the ITC, there are other federal incentives such as grants and loans that can help lower the cost of installing solar panels. These incentives vary depending on your location and specific circumstances, so it's important to do your research or consult with a solar energy professional to see which options are available to you.

State Solar Incentives

Many states also offer incentives to promote the use of solar energy. These incentives can include rebates, tax credits, performance-based incentives, and more. State incentives can vary widely, so be sure to check what is available in your area.

Local Solar Incentives

In addition to federal and state incentives, some local governments and utilities offer their own incentives to encourage the installation of solar panels. These incentives can include property tax exemptions, expedited permitting processes, and more. Be sure to check with your local government and utility providers to see what options are available to you.

Tax Credits and Rebates

In addition to the federal, state, and local incentives, there are also various tax credits and rebates available to homeowners who install solar panels. These can further reduce the cost of your solar panel system and increase your overall savings. Be sure to take advantage of all the incentives available to you to maximize the benefits of going solar.

Financing Options

If the upfront cost of installing solar panels is still a concern, there are various financing options available to make it more affordable. Options such as solar loans, leases, and power purchase agreements can help you spread out the cost of your system over time, making it easier to go solar without breaking the bank.

Calculating Your Savings

When considering going solar, it's important to calculate the potential savings you can achieve over time. By factoring in incentives, tax credits, rebates, financing options, and energy savings, you can get a clear picture of how much you can save by making the switch to solar energy.

In conclusion, with all the incentives available, going solar has never been more rewarding. By taking advantage of federal, state, and local incentives, as well as tax credits, rebates, and financing options, you can make the switch to solar energy more affordable and beneficial for your home. So why wait? Start exploring your options today and reap the rewards of going solar.

Solar energy is not only environmentally friendly but can also save you money in the long run. One of the key factors that make solar energy more accessible and affordable for homeowners are the various incentives offered at the federal, state, and local levels. Let's delve into the realm of federal solar incentives and explore how you can take advantage of them to make your solar panel installation more cost-effective.

The federal government offers a Residential Renewable Energy Tax Credit, which allows you to claim a percentage of the cost of your solar panel system as a credit on your federal taxes. As of 2021, this tax credit covers up to 26% of the total cost of your solar system, including installation. This means that if you spend $10,000 on a solar panel system, you can get a tax credit of $2,600.

Additionally, the federal government offers a Federal Solar Power Investment Tax Credit (ITC) for commercial properties, which allows businesses to claim a tax credit of up to 26% of the cost of their solar energy systems. This tax credit can significantly reduce the upfront cost of installing solar panels for businesses, making it a more attractive investment.

Another federal incentive to consider is the USDA Rural Energy for America Program (REAP), which provides grants and loan guarantees to agricultural producers and rural small businesses for renewable energy projects, including solar panel installations. This program can help offset the cost of going solar for those in rural areas, making it more accessible to a wider range of homeowners.

In addition to these federal incentives, some utility companies may offer rebates or incentives for installing solar panels. These can vary depending on your location, so it's worth checking with your local utility company to see if they offer any additional incentives that can help offset the cost of going solar.

By taking advantage of these federal solar incentives, you can make your solar panel installation more affordable and start reaping the benefits of clean, renewable energy. Remember to consult with a solar energy expert to ensure you maximize your savings and take full advantage of the incentives available to you. With a little research and planning, you can make your transition to solar energy a smooth and cost-effective one.

State Solar Incentives

When it comes to installing solar panels on your home, it's essential to look into the various state solar incentives available to you. These incentives can significantly reduce the overall cost of going solar and make it more affordable for homeowners. Each state offers different incentives, so it's important to research what is available in your area.

One common state incentive is the Solar Renewable Energy Certificate (SREC) program. Under this program, homeowners can earn credits for the electricity generated by their solar panels. These credits can then be sold on the market, providing additional income for homeowners. In some states, SRECs can significantly reduce the payback period for your solar panel investment.

Another popular state incentive is the property tax exemption for solar energy systems. Many states offer a property tax exemption for the increased value that solar panels add to your home. This means that you won't have to pay additional property taxes on the value of your solar panels, saving you money in the long run.

Additionally, some states offer cash rebates or grants for installing solar panels. These incentives can help offset the upfront cost of purchasing and installing solar panels, making it more accessible for homeowners. Some states also offer low-interest loans for solar energy installations, making it easier to finance your solar panel system.

It's important to note that state incentives vary widely, so it's crucial to research what is available in your specific state. You can check with your state's energy office or local utility company to find out what incentives are available to you. Additionally, the Database of State Incentives for Renewables & Efficiency (DSIRE) is a great resource for finding information on state incentives for solar energy.

Local Solar Incentives

When considering installing solar panels on your home, it's essential to look beyond federal and state incentives and explore local incentives that may be available to you. Local solar incentives can vary widely depending on where you live, so it's worth taking the time to research what programs are offered in your area.

One common type of local solar incentive is a property tax exemption or reduction for homes with solar panels. This can help offset the initial cost of installing solar panels and make it more affordable in the long run. Some local governments also offer grants or rebates to homeowners who install solar panels, further reducing the upfront cost.

Another valuable local incentive to look out for is a net metering program. Net metering allows homeowners to sell excess electricity generated by their solar panels back to the grid, providing a credit on their electricity bill. This can result in significant savings over time, as you can offset the cost of electricity you would have otherwise purchased from the utility company.

In some areas, local governments may offer low-interest loans or financing options specifically for solar panel installations. These programs can make it easier for homeowners to afford the upfront costs of going solar, with the added benefit of potentially saving money on their electricity bills in the future.

Additionally, some municipalities offer expedited permitting processes for solar panel installations, making it quicker and easier for homeowners to get their systems up and running. By streamlining the permitting process, local governments can help reduce the time and hassle associated with installing solar panels on your home.

To find out what local solar incentives are available in your area, start by checking your city or county's website for information on renewable energy programs. You can also reach out to local solar installers who are likely familiar with the incentives available in your area and can help guide you through the process of taking advantage of them.

Remember, every little bit helps when it comes to making solar energy more affordable for homeowners. By taking advantage of local solar incentives in addition to federal and state programs, you can maximize your savings and make the switch to solar power a smart financial decision for your home.

So, be sure to do your research, reach out to local resources, and take advantage of the incentives available in your area to make your solar panel installation as cost-effective as possible. With the right local incentives, going solar can be a rewarding and money-saving investment for your home.

When it comes to installing solar panels on your home, one of the key factors to consider is how you can take advantage of tax credits and rebates to help offset the initial cost. These incentives can significantly reduce the overall price of your solar panel system, making it a more affordable and attractive option for many homeowners.

Tax Credits

One of the most common incentives available to homeowners who install solar panels is the Federal Investment Tax Credit (ITC). This credit allows you to deduct a percentage of the total cost of your solar panel system from your federal taxes. As of 2021, the ITC allows you to deduct 26% of the cost of your system from your taxes. This percentage is set to decrease in the coming years, so it's important to take advantage of this credit while you can.

In addition to the federal ITC, many states also offer their own tax incentives for solar panel installations. These incentives can vary widely from state to state, so it's important to research what is available in your area. Some states offer additional tax credits, rebates, or exemptions that can further reduce the cost of your system.

Rebates

Some utility companies and local governments offer rebates to homeowners who install solar panels. These rebates can provide a direct financial incentive to help offset the cost of your system. Rebates can vary in amount and eligibility requirements, so be sure to check with your utility company or local government to see what options are available to you.

Financing Options

While tax credits and rebates can help reduce the upfront cost of your solar panel system, there are also financing options available to make the investment more manageable. Many homeowners choose to finance their solar panels through loans, leases, or power purchase agreements. These options allow you to pay for your system over time, making solar energy more accessible to a wider range of homeowners.

When considering financing options, be sure to compare interest rates, terms, and fees to find the best option for your budget. Some financing options may offer lower upfront costs but higher long-term expenses, so it's important to weigh the pros and cons of each before making a decision.

By taking advantage of tax credits, rebates, and financing options, you can make installing solar panels on your home more affordable and financially beneficial in the long run. Be sure to research what incentives are available in your area and consult with a solar energy expert to determine the best approach for your specific situation. With the right incentives and financing in place, you can enjoy the numerous benefits of solar energy while also saving money on your investment.

Solar panels are a great investment for your home, not only for the environment but also for your wallet. However, the upfront cost of installing a solar panel system can sometimes be a deterrent. That's where financing options come in to make going solar more affordable and accessible.

Financing Options

1. Solar Loans:

One of the most common ways to finance your solar panel system is through a solar loan. These loans are specifically designed for solar installations and offer competitive interest rates. With a solar loan, you can spread out the cost of your system over time, making it more manageable to pay for the upfront installation costs. Additionally, many solar loans require $0 down payment, making it easier to get started on your solar journey.

2. Solar Leases:

Another popular financing option is a solar lease. With a solar lease, you essentially rent the solar panel system from a third-party provider. This means you can enjoy the benefits of solar energy without having to pay for the system upfront. While you won't own the system, you can still save on your electricity bills and reduce your carbon footprint.

3. Power Purchase Agreements (PPAs):

PPAs are similar to solar leases but with a slight difference. Instead of paying a fixed monthly lease payment, you pay for the electricity generated by the solar panels at a predetermined rate. This can be a great option for homeowners who want to enjoy the benefits of solar energy without any upfront costs.

4. Home Equity Loans:

If you have equity in your home, you can also consider using a home equity loan to finance your solar panel system. By borrowing against the value of your home, you can get a lower interest rate compared to other forms of financing. This can be a smart way to finance your solar installation while leveraging your home's equity.

5. Property Assessed Clean Energy (PACE) Financing:

PACE financing allows homeowners to finance their solar panel system through a special assessment on their property taxes. This means you can pay for your solar installation over time through your property tax bill. PACE financing is often a good option for homeowners who may not qualify for traditional financing options.

When it comes to choosing the right financing option for your solar panel system, it's essential to consider your financial goals, credit score, and long-term plans. By exploring these financing options and finding the one that works best for you, you can make going solar a reality for your home. Remember, the benefits of solar energy go beyond just saving money – you'll also be contributing to a cleaner and more sustainable future for generations to come.

Solar energy is a great way to power your home while reducing your carbon footprint and saving money on your energy bills. One of the most appealing aspects of solar power is the potential for significant savings over time. Calculating your potential savings can help you make an informed decision about whether or not to invest in solar panels for your home.

There are several factors to consider when calculating your savings from solar energy. First, you'll need to determine how much energy your solar panels are expected to generate. This can vary based on factors such as the size of your system, the amount of sunlight your location receives, and the efficiency of your panels. You can use online tools or consult with a solar energy provider to get an estimate of how much energy your system will produce.

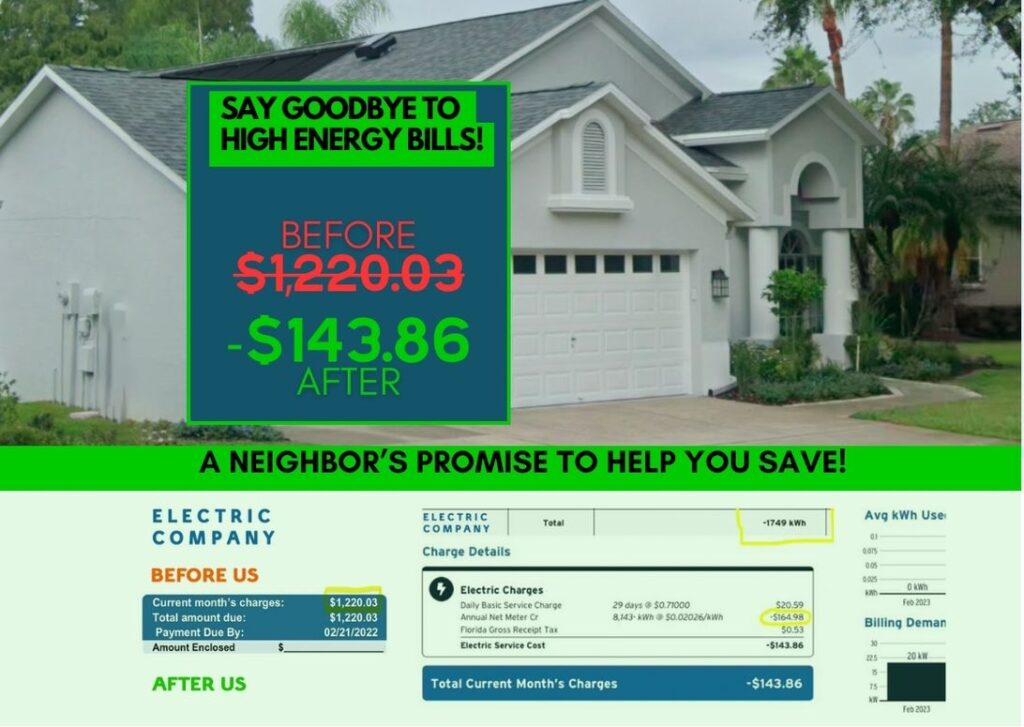

Next, you'll need to consider how much you currently pay for electricity. By comparing the cost of solar energy to the cost of grid electricity, you can estimate how much you'll save each month on your energy bills. Keep in mind that the cost of electricity from your utility company is likely to increase over time, while the cost of solar energy will remain relatively stable once your system is installed.

In addition to saving money on your energy bills, you may also be eligible for tax credits or rebates that can further reduce the cost of installing solar panels. Federal, state, and local incentives can help offset the upfront cost of your system, making solar energy even more affordable. Be sure to research the incentives available in your area and take advantage of any programs that can help you save money.

When calculating your savings from solar energy, it's important to consider the long-term benefits as well. Solar panels have a lifespan of 25 years or more, so you'll continue to save money on your energy bills for decades to come. In addition, installing solar panels can increase the value of your home, making it a smart investment for the future.

Overall, calculating your savings from solar energy is a crucial step in the decision-making process. By taking into account factors such as energy production, energy costs, incentives, and long-term benefits, you can determine whether solar panels are a good fit for your home. With the potential for significant savings and a reduced environmental impact, solar energy is a smart choice for homeowners looking to take control of their energy usage and reduce their carbon footprint.

Calculating Your Savings

Solar energy is a great way to power your home while reducing your carbon footprint and saving money on your energy bills. One of the most appealing aspects of solar power is the potential for significant savings over time. Calculating your potential savings can help you make an informed decision about whether or not to invest in solar panels for your home.

- Determine how much energy your solar panels are expected to generate.

- Compare the cost of solar energy to the cost of grid electricity.

- Consider tax credits or rebates that can reduce the cost of installation.

- Take into account the long-term benefits of solar energy.

When calculating your savings from solar energy, it's important to consider the long-term benefits as well. Solar panels have a lifespan of 25 years or more, so you'll continue to save money on your energy bills for decades to come. In addition, installing solar panels can increase the value of your home, making it a smart investment for the future.

Overall, calculating your savings from solar energy is a crucial step in the decision-making process. By taking into account factors such as energy production, energy costs, incentives, and long-term benefits, you can determine whether solar panels are a good fit for your home. With the potential for significant savings and a reduced environmental impact, solar energy is a smart choice for homeowners looking to take control of their energy usage and reduce their carbon footprint.