Solar panels are a fantastic investment for your home, offering a sustainable and cost-effective way to generate energy. However, the upfront costs can sometimes be a barrier for homeowners looking to make the switch to solar power. That's where financing options come into play, making it easier for you to reap the benefits of solar energy without breaking the bank. In this article, we'll delve into the world of financing solar panels, exploring the various options available and how you can take advantage of them to bring solar power to your doorstep.

When considering installing solar panels in your home, one crucial aspect to think about is how to finance this sustainable investment. Financing solar panels offers a range of benefits that can make transitioning to solar energy more accessible and cost-effective for homeowners.

Benefits of Financing Solar Panels:

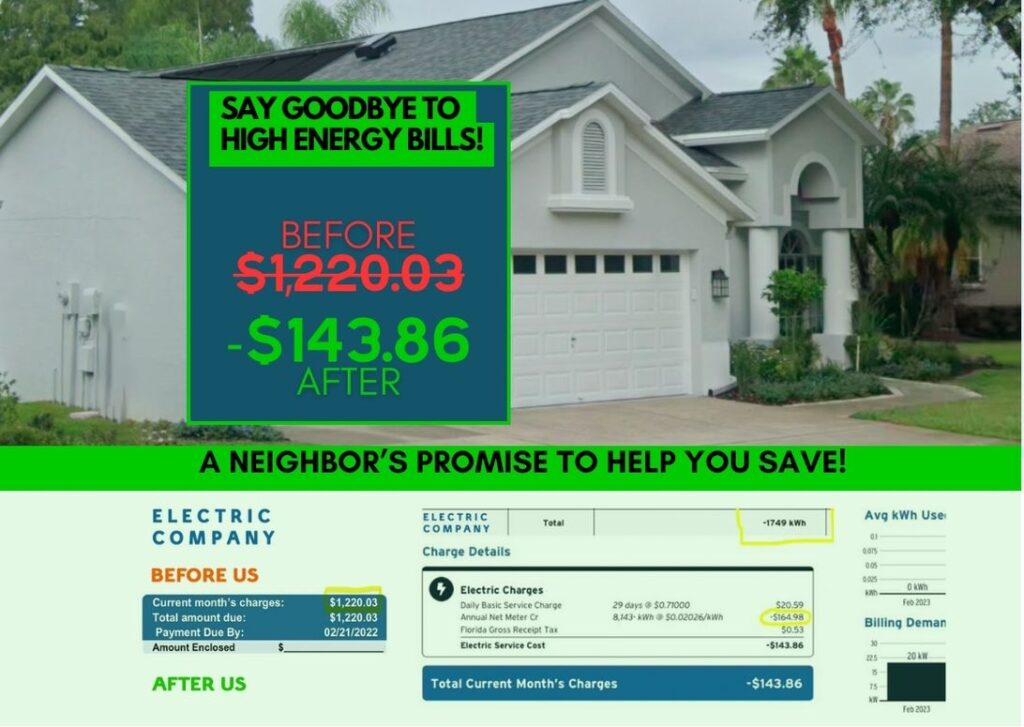

- Cost Savings: By financing solar panels, you can start saving money on your electricity bills from day one. The monthly payments for your solar system are often lower than your current utility bill, allowing you to recoup your investment over time.

- No Upfront Costs: Financing options eliminate the need for a large upfront payment, making it easier for homeowners to afford solar panel installation. This way, you can start enjoying the benefits of solar energy without a significant financial burden.

- Tax Incentives: Many financing programs offer tax incentives, rebates, and other financial benefits that can further reduce the overall cost of going solar. Taking advantage of these incentives can significantly increase your return on investment.

- Increased Home Value: Installing solar panels can boost the value of your home. A solar energy system is considered a valuable asset that can make your property more attractive to potential buyers if you decide to sell in the future.

- Eco-Friendly Investment: By financing solar panels, you are not only saving money but also contributing to a cleaner environment. Solar energy is a renewable and sustainable source of power that reduces your carbon footprint and helps combat climate change.

These are just a few of the benefits that come with financing solar panels for your home. With the right financing option, you can make the switch to solar energy a seamless and rewarding experience.

GoSolarEasy offers a variety of financing options to make solar panel installation more accessible and affordable for homeowners. Understanding these options is crucial for making informed decisions when it comes to investing in renewable energy. Let's take a closer look at the financing options available through GoSolarEasy.

Understanding GoSolarEasy's Financing Options

GoSolarEasy provides flexible financing solutions tailored to meet the diverse needs of homeowners looking to install solar panels. Whether you're interested in purchasing solar panels outright or opting for a financing plan, GoSolarEasy has you covered.

1. Solar Loan:

With a solar loan from GoSolarEasy, you can finance your solar panel system while enjoying low-interest rates and flexible repayment terms. This option allows you to own your solar panels outright and take advantage of various incentives and tax benefits.

2. Solar Lease:

If you prefer not to purchase solar panels, GoSolarEasy offers solar lease options that allow you to lease the equipment for a fixed monthly fee. This option is ideal for homeowners looking to go solar without a significant upfront investment.

3. Power Purchase Agreement (PPA):

Under a PPA arrangement, GoSolarEasy installs solar panels on your property at no upfront cost. You then pay for the electricity generated by the solar panels at a predetermined rate, typically lower than standard utility rates. This option provides immediate savings on your energy bills.

By understanding these financing options, you can choose the solution that best fits your financial goals and energy needs. GoSolarEasy's team of experts can help you navigate the different financing plans and select the one that aligns with your budget and sustainability objectives.

Eligibility Requirements for Financing

So, you've decided to make the switch to solar energy and are looking for financing options to make it happen. Before you dive into the world of solar panel financing, it's essential to understand the eligibility requirements that you'll need to meet. Don't worry; it's not as complicated as it may seem!

Here are some common criteria that most financing companies, like GoSolarEasy, require for you to be eligible for their solar panel financing programs:

- Credit Score: While each company may have different minimum credit score requirements, having a good credit score is generally essential for securing financing for your solar panels. A higher credit score can often lead to better terms and lower interest rates, so it's worth maintaining a healthy credit score.

- Income: Your income is another crucial factor that financing companies will consider. They want to ensure that you have the financial means to make your monthly payments on time. This helps reduce the risk for both you and the company.

- Homeownership: Since solar panels are typically installed on rooftops, most financing companies require that you own the property where the solar panels will be installed. If you're renting, you may need to get permission from your landlord to proceed with the installation.

- Location: Some financing programs may have specific geographic restrictions, so make sure to check if your location is eligible for the financing you're considering. Certain areas may offer incentives or rebates for solar panel installations, so it's worth exploring what's available in your area.

These are just a few of the common eligibility requirements that you may encounter when applying for solar panel financing. It's essential to carefully review the specific requirements of the financing program you're interested in to ensure that you meet all the criteria.

Remember, if you're unsure about your eligibility or have any questions, don't hesitate to reach out to the financing company for clarification. They're there to help you navigate the process and find the best financing option for your solar panel installation.

By understanding and meeting the eligibility requirements for solar panel financing, you'll be well on your way to powering your home with clean, renewable energy. So, don't let these requirements deter you; instead, use them as a guide to make your solar energy dreams a reality!

Steps to Apply for Financing with GoSolarEasy

So, you've decided to take the leap and invest in solar panels for your home. Congratulations! Now, let's talk about how you can apply for financing with GoSolarEasy to make this dream a reality.

1. Research Your Options

Before you begin the application process, it's essential to research the different financing options available to you. GoSolarEasy offers a variety of plans tailored to meet your specific needs, so take the time to understand each one and choose the one that best fits your budget and goals.

2. Check Your Eligibility

Make sure you meet the eligibility requirements set by GoSolarEasy. This may include factors such as your credit score, income level, and home ownership status. If you have any questions about eligibility, don't hesitate to reach out to a representative for clarification.

3. Gather Necessary Documents

Be prepared to provide certain documents when applying for financing. This may include proof of income, identification, and information about your property. Having these documents ready will streamline the application process and help you get approved faster.

4. Submit Your Application

Once you've done your research, checked your eligibility, and gathered all necessary documents, it's time to submit your application. The application process with GoSolarEasy is user-friendly and straightforward, so you can easily navigate through the steps and provide the required information.

5. Review and Approval

After you've submitted your application, sit back and relax while GoSolarEasy reviews your information. The approval process typically doesn't take long, and you'll receive notification once your application has been processed. If any additional information is needed, the team will reach out to you promptly.

6. Begin Your Solar Panel Installation

Once your financing has been approved, it's time to start the exciting process of installing your solar panels. GoSolarEasy will work with you every step of the way to ensure a seamless and efficient installation process, so you can start enjoying the benefits of clean, renewable energy in no time.

By following these steps and working with GoSolarEasy, you'll be well on your way to harnessing the power of the sun and reducing your carbon footprint. Don't wait any longer – apply for financing today and take the first step towards a brighter, more sustainable future for you and your home!

Tips for Maximizing Solar Panel Financing

Congratulations on taking the first step towards a more sustainable and cost-effective energy solution for your home with solar panels! Now that you've decided to finance your solar panel system, here are some tips to help you maximize your financing options and get the most out of your investment:

- Evaluate Your Energy Consumption: Before you apply for financing, it's important to understand how much energy your household consumes. By knowing your energy needs, you can select the right size solar panel system that will offset your energy usage and maximize your savings.

- Compare Financing Options: Don't settle for the first financing option you come across. Take the time to compare different lenders, interest rates, and terms to find the best deal that fits your budget and financial goals. GoSolarEasy offers competitive financing options tailored to meet your specific needs.

- Consider Incentives and Rebates: Take advantage of federal and state incentives, tax credits, and rebates available for installing solar panels. These financial incentives can significantly reduce the upfront cost of your solar panel system and make financing more affordable.

- Opt for Flexible Payment Plans: Look for financing options that offer flexible payment plans to accommodate your budget. Whether you prefer fixed monthly payments or variable interest rates, choose a plan that aligns with your financial situation and allows you to comfortably repay your loan.

- Invest in Energy-Efficient Upgrades: Consider bundling energy-efficient upgrades with your solar panel system to further enhance your home's energy efficiency. Upgrades such as smart thermostats, LED lighting, and energy-efficient appliances can help reduce your energy consumption and maximize your savings in the long run.

- Maintain Your Solar Panels: Regular maintenance and monitoring of your solar panel system are essential to ensure optimal performance and longevity. By keeping your panels clean, checking for any damage, and scheduling periodic inspections, you can protect your investment and maximize your energy production.

- Monitor Your Energy Usage: Track your energy production and consumption to monitor your savings and identify any areas for improvement. By analyzing your energy data, you can adjust your usage habits, optimize your solar panel system, and further reduce your energy bills.

By following these tips and leveraging GoSolarEasy's financing options, you can make the most of your solar panel investment and enjoy the long-term benefits of clean, renewable energy for your home. If you have any questions or need assistance with your solar panel financing, feel free to reach out to our team of experts. We're here to help you every step of the way on your journey to a greener and more sustainable future!

In Conclusion and Next Steps:

Now that you have a better understanding of how financing solar panels can benefit you and your home, it's time to take the next steps towards a brighter, more sustainable future. Installing solar panels not only helps you save money on your energy bills but also reduces your carbon footprint, contributing to a healthier planet for future generations.

To ensure a smooth process, remember to carefully review the financing options available through GoSolarEasy. Take note of the eligibility requirements and gather all necessary documents to streamline your application. By following these steps, you can maximize your chances of securing financing for your solar panel system.

As you embark on this journey, keep in mind that solar panel financing is an investment in your home and the environment. By making this choice, you are not only enhancing the value of your property but also making a positive impact on the world around you. So, take the leap and make the switch to solar energy today.

Don't hesitate to reach out to GoSolarEasy for any further assistance or information. Our team of experts is here to guide you through the process and answer any questions you may have. Together, we can work towards a cleaner, greener future powered by the sun.

Congratulations on taking the first step towards a sustainable lifestyle. Your decision to go solar will not only benefit you but will also contribute to a more sustainable world for all. Embrace the power of solar energy and enjoy the many rewards it has to offer.

Let's make a positive impact together. Start your solar panel financing journey today and experience the benefits of clean, renewable energy firsthand. The future is bright with solar power – take the leap and join the solar revolution!