Are you considering installing solar panels in your home in Tampa, but wondering how to finance such a project? You're not alone! Many homeowners are interested in harnessing the power of solar energy, but the upfront costs can be a barrier. That's where solar panel financing comes in to help make this sustainable energy solution more accessible.

Introduction to Solar Panel Financing in Tampa

Solar panel financing allows homeowners to spread out the cost of solar panel installation over time, making it more affordable and manageable. In Tampa, there are various financing options available to help you go solar without breaking the bank.

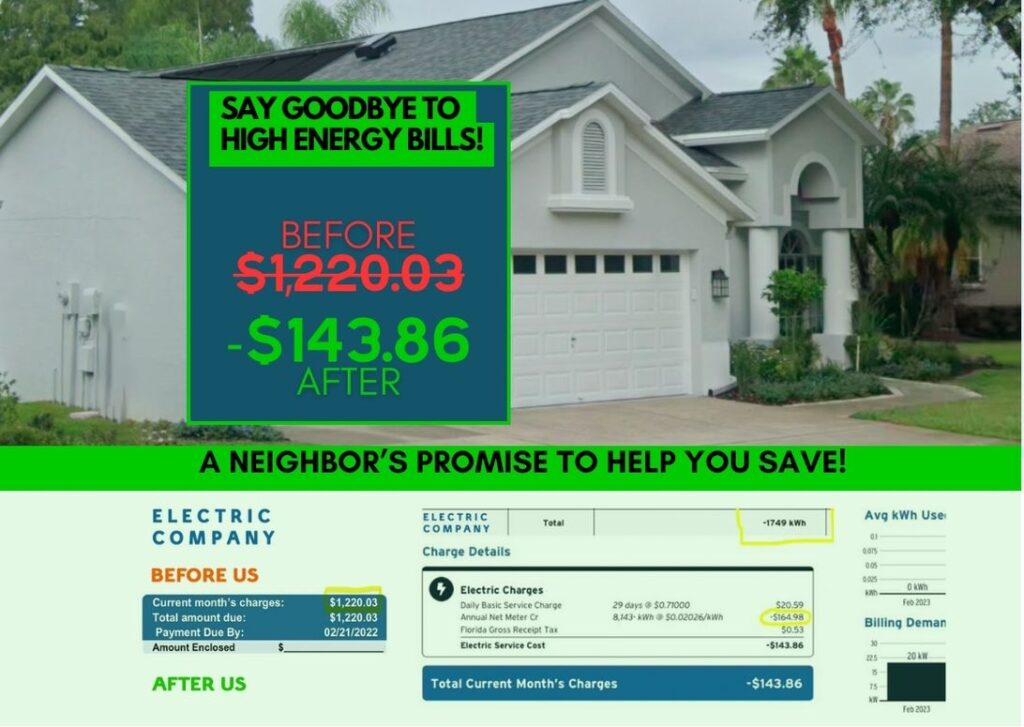

Whether you're looking to reduce your carbon footprint, lower your electricity bills, or increase the value of your home, solar panels are a smart investment. And with the right financing, you can start reaping the benefits of solar energy sooner rather than later.

But before diving into the world of solar panel financing, it's essential to understand how your credit score plays a crucial role in the process. A good credit score can open doors to better financing options, while a poor credit score may limit your choices.

Stay tuned to learn more about the importance of credit score in solar panel financing, alternative options for low credit scores, tips to improve your credit score, local programs and incentives in Tampa, finding the right financing provider, and real-life success stories of homeowners who have successfully gone solar.

With the right information and resources at your fingertips, you can make an informed decision about financing your solar panel installation in Tampa. Let's explore the world of solar panel financing together and embark on a journey towards a greener and more sustainable future!

Importance of Credit Score in Solar Panel Financing

So, you've decided to make the switch to solar power for your home in Tampa – that's great news! However, before you can start enjoying the benefits of clean, renewable energy, you need to figure out how to finance your solar panel installation. One crucial factor that will influence your financing options is your credit score.

Your credit score plays a significant role in determining your eligibility for solar panel financing and the terms you may be offered. Lenders use your credit score to assess your creditworthiness and determine the level of risk associated with lending you money. A higher credit score typically means better financing options, such as lower interest rates and more favorable terms.

When it comes to solar panel financing, a good credit score can save you money in the long run. With a higher credit score, you are more likely to qualify for competitive financing options, which can result in lower monthly payments and overall cost savings over the life of your solar panel system.

What credit score do you need for solar panel financing?

While specific credit score requirements can vary depending on the lender, a credit score of 650 or higher is generally considered good for solar panel financing. However, even if your credit score is lower than 650, you still have options available to finance your solar panel installation.

Even if you have a less-than-perfect credit score, don't let that discourage you from exploring solar panel financing options. There are alternative financing solutions and programs specifically designed to help homeowners with lower credit scores access solar power.

Improving your credit score for better solar panel financing

If you are concerned about your credit score impacting your ability to finance solar panels, there are steps you can take to improve your creditworthiness. Start by reviewing your credit report, addressing any errors or negative items, and consistently making on-time payments on your existing debts.

By taking proactive steps to improve your credit score, you can increase your chances of qualifying for better solar panel financing options and potentially save money on your solar installation in the long run.

Remember, your credit score is just one piece of the puzzle when it comes to solar panel financing. It's essential to explore all of your financing options, including local programs and incentives, to find the best solution for your needs and budget.

Alternative Financing Options for Low Credit Scores

Are you interested in installing solar panels in your home but worried about your credit score holding you back? Don't fret! There are alternative financing options available that can help you achieve your goal of going solar, even with a less than perfect credit history.

1. Solar Lease or Power Purchase Agreement (PPA):

With a solar lease or PPA, you can have solar panels installed on your property without having to pay the full upfront cost. This option allows you to pay a fixed monthly fee for the use of the solar panels and the energy they produce, without the need for a high credit score.

2. Solar Loan with a Co-Signer:

If your credit score is preventing you from qualifying for a traditional solar loan, consider applying with a co-signer. A co-signer with a good credit history can help strengthen your loan application and increase your chances of approval.

3. Home Equity Loan or Line of Credit:

Another option for financing your solar panel installation is to use your home equity. By taking out a home equity loan or line of credit, you can tap into the value of your home to fund your solar project. This option may be more accessible even with a lower credit score.

4. Community Solar Programs:

Community solar programs allow multiple households to share the benefits of a solar energy system. By joining a community solar program, you can enjoy the advantages of solar energy without the need for upfront costs or a high credit score.

5. Energy-Efficient Mortgages:

Some lenders offer energy-efficient mortgages that can help finance solar panel installations and other energy-saving upgrades to your home. These loans take into account the energy efficiency improvements, rather than just your credit score, making them a viable option for those with lower credit scores.

6. In-House Financing from Solar Installers:

Many solar companies offer in-house financing options for their customers. These financing plans may have more flexible requirements than traditional lenders, making them a great choice for those with lower credit scores.

While having a good credit score can make it easier to secure solar panel financing, it is not the only determining factor. By exploring these alternative financing options and working with reputable solar companies, you can still achieve your goal of going solar, regardless of your credit history. Remember, going solar not only benefits the environment but can also lead to long-term savings on your energy bills. So don't let your credit score hold you back from harnessing the power of the sun!

Now, let's talk about how you can improve your credit score to secure better financing options for your solar panel installation in Tampa. Your credit score plays a crucial role in determining the interest rates and loan terms you will be offered.

Here are some practical tips to help you boost your credit score:

1. Check Your Credit Report Regularly: Start by obtaining a copy of your credit report from the major credit bureaus such as Equifax, Experian, and TransUnion. Review the report for any errors or discrepancies that could be negatively impacting your score.

2. Pay Your Bills on Time: One of the most significant factors affecting your credit score is your payment history. Make sure to pay all your bills on time, including credit card payments, loan installments, and utility bills.

3. Reduce Your Debt: High credit card balances can lower your credit score. Try to pay down your existing debt to improve your credit utilization ratio, which is the amount of credit you are using compared to your total available credit.

4. Avoid Opening Too Many New Accounts: Opening multiple new credit accounts in a short period can lower your credit score. Limit the number of new accounts you open and only apply for credit when necessary.

5. Keep Old Accounts Open: The length of your credit history is also essential for your credit score. Keep old accounts open, even if you no longer use them, to demonstrate a longer credit history.

6. Use Credit Responsibly: Make sure to use credit responsibly and avoid maxing out your credit cards. Aim to keep your credit utilization below 30% to maintain a healthy credit score.

7. Consider a Secured Credit Card: If you have a low credit score, you may want to consider applying for a secured credit card. Secured cards require a security deposit and can help you build or rebuild your credit over time.

By following these tips and actively working to improve your credit score, you can increase your chances of qualifying for better financing options for your solar panel installation in Tampa. Remember that a higher credit score not only opens up more financing opportunities but also allows you to secure better terms and rates, ultimately saving you money in the long run.

Local Programs and Incentives for Solar Panel Installation

So, you're thinking about making the switch to solar energy for your home in Tampa? That's a fantastic decision! Not only will you be reducing your carbon footprint and contributing to a cleaner environment, but you'll also be saving money on your energy bills in the long run. However, the cost of installing solar panels can be a major deterrent for many homeowners. That's where local programs and incentives come in to make the transition to solar power more affordable and accessible.

1. Federal Tax Credits

One of the most significant incentives for installing solar panels is the Federal Investment Tax Credit (ITC). This credit allows you to deduct a percentage of the cost of your solar panel system from your federal taxes. Currently, the ITC covers 26% of the total cost of installation, making it a substantial savings opportunity for homeowners in Tampa.

2. Local Rebates and Incentives

Many local utility companies and government agencies offer rebates and incentives to encourage homeowners to go solar. These incentives can help offset the upfront costs of installation and make solar energy more affordable for everyone. Be sure to check with your utility provider and local government to see what programs are available in your area.

3. Property Assessed Clean Energy (PACE) Financing

PACE financing is another option for homeowners looking to finance their solar panel installation. With PACE financing, you can borrow money to cover the cost of your solar panels and repay the loan through an additional assessment on your property tax bill. This can be a great alternative for those who may not qualify for traditional financing options.

4. Net Metering

Net metering is a policy that allows homeowners with solar panels to sell excess energy back to the grid. This can result in significant savings on your monthly energy bills and even earn you credits from your utility company. It's a win-win situation that rewards you for your investment in renewable energy.

By taking advantage of these local programs and incentives, you can make the switch to solar energy more affordable and accessible for your home in Tampa. Not only will you be saving money in the long run, but you'll also be doing your part to create a cleaner and more sustainable future for generations to come.

VI. Finding the Right Solar Panel Financing Provider in Tampa

So, you've decided to take the leap and invest in solar panels for your home in Tampa. Congratulations! You're not only making a smart choice for the environment but also for your wallet in the long run. Now comes the important step of finding the right solar panel financing provider to help make your green energy dreams a reality.

When it comes to selecting a financing provider for your solar panel installation, there are a few key factors to consider:

1. Reputation and Experience

Look for a financing provider that has a solid reputation in the industry and a track record of successfully financing solar projects. Experience matters when it comes to navigating the complexities of solar panel financing, so choose a provider that has been around for a while and has a proven history of helping homeowners like yourself.

2. Transparent Terms and Rates

Make sure to carefully review the terms and rates offered by different financing providers. Look for transparency in their pricing structure and make sure there are no hidden fees or surprises down the line. Compare rates from multiple providers to ensure you're getting the best deal for your solar panel installation.

3. Customer Support and Service

Customer support is key when it comes to choosing a solar panel financing provider. You want to work with a provider that offers excellent customer service, is responsive to your questions and concerns, and is there to guide you through the financing process every step of the way. Look for reviews and testimonials from other customers to get a sense of the provider's customer service reputation.

4. Financing Options and Flexibility

Not all solar panel financing providers offer the same types of financing options. Some may specialize in loans, while others may offer leasing or power purchase agreements. Consider your own financial situation and preferences when it comes to choosing the right financing option for your solar panel installation. Look for a provider that offers flexibility in their financing options to best suit your needs.

By taking the time to research and compare different solar panel financing providers in Tampa, you can ensure that you're making an informed decision that aligns with your goals and budget. Remember, investing in solar panels is not just about saving money—it's also about making a positive impact on the environment and reducing your carbon footprint. Choose a financing provider that shares your values and vision for a greener future.

Case Studies: Successful Solar Panel Financing Stories in Tampa

Are you considering installing solar panels in your home but worried about the financing options available in Tampa? Let's take a look at some inspiring case studies of individuals who successfully financed their solar panel systems in the area. These real-life stories might provide you with valuable insights and motivation to kickstart your own solar panel journey.

Case Study 1: Sarah and John

Sarah and John, a young couple living in Tampa, were eager to reduce their carbon footprint and save on their electricity bills. However, they were concerned about the upfront costs of installing solar panels. After researching various financing options, they decided to opt for a solar loan with a local credit union. With the help of the loan, they were able to install a high-quality solar panel system on their roof. Over time, they saw a significant decrease in their energy bills and even received tax incentives for their environmentally friendly choice.

Key Takeaway: Consider exploring solar loans offered by local financial institutions for flexible and affordable financing options.

Case Study 2: Mark

Mark, a homeowner in Tampa with a modest income, was passionate about sustainability but struggled to find affordable solar panel financing due to his low credit score. Determined to go solar, Mark reached out to local non-profit organizations that offered assistance to individuals with financial challenges. Through a subsidy program, Mark was able to access a grant to cover a portion of the installation costs. He also enrolled in a community solar program, allowing him to benefit from solar energy without the need for upfront investment.

Key Takeaway: Don't let a low credit score deter you from going solar. Explore community programs and financial assistance options available in Tampa to make your solar dreams a reality.

Case Study 3: Lisa

Lisa, a retiree in Tampa, was concerned about the impact of rising electricity costs on her fixed income. She decided to invest in solar panels to secure long-term savings and reduce her reliance on the grid. Despite having limited savings, Lisa was able to finance her solar panel system through a power purchase agreement (PPA) with a reputable solar provider. With the PPA, Lisa only paid for the solar energy generated by her panels, allowing her to enjoy immediate savings without the burden of high upfront costs.

Key Takeaway: Explore innovative financing options like power purchase agreements to make solar panel installation affordable and accessible, especially for individuals on fixed incomes.

These case studies demonstrate that with careful research, strategic planning, and the right financing options, installing solar panels in Tampa can be a feasible and rewarding investment. Whether you choose a solar loan, subsidy program, or power purchase agreement, there are various pathways to make solar energy a reality for your home. Remember, each solar panel financing journey is unique, so don't hesitate to explore different options and seek guidance from local experts to find the best solution tailored to your needs. Happy solar panel financing!