Are you considering making the switch to solar energy for your home in Tampa but unsure of how to finance such a project? You're not alone! Many homeowners are interested in harnessing the power of the sun to reduce their energy bills and their carbon footprint, but the upfront costs of installing solar panels can be a significant barrier.

That's where solar panel financing comes in. With various financing options available, going solar has never been more accessible or affordable for Tampa residents. In this guide, we'll explore the ins and outs of solar panel financing and help you navigate the process of securing funding for your solar energy project.

Installing solar panels on your home is a fantastic way to save money on your electricity bills and reduce your carbon footprint. However, the initial cost of purchasing and installing a solar panel system can be quite significant. That's where solar panel financing comes in to help make solar energy more accessible to homeowners in Tampa.

Pros of Solar Panel Financing

One of the biggest advantages of solar panel financing is that it allows you to start reaping the benefits of solar energy without having to pay the full cost upfront. Instead of shelling out thousands of dollars for a solar panel system, you can spread out the cost over time through financing options such as loans or leases.

Financing your solar panels also allows you to take advantage of the immediate savings on your electricity bills. By generating your own clean energy, you can significantly reduce or even eliminate your monthly electricity costs, making it easier to pay off your financing over time.

Furthermore, solar panel financing can increase the value of your home. Studies have shown that homes equipped with solar panels sell faster and at a higher price than those without, making it a smart investment in the long run.

Another benefit of solar panel financing is that it often comes with little to no money down options. This means you can start enjoying the benefits of solar energy right away without having to come up with a large sum of money upfront.

Additionally, financing your solar panels can also help you take advantage of government incentives and tax credits that are available for solar energy systems. These financial incentives can help offset the cost of your solar panel installation, making it even more affordable in the end.

Overall, solar panel financing can make going solar a reality for many homeowners who may not have the means to pay for a system upfront. It makes the transition to clean, renewable energy more accessible and affordable, allowing you to enjoy the benefits of solar power without breaking the bank.

Cons of Solar Panel Financing

So, you're thinking about installing solar panels on your home in Tampa, but you're a bit hesitant about the financing aspect. Don't worry; you're not alone! Let's dive into some of the cons of solar panel financing to help you make an informed decision.

1. Upfront Costs: One of the main drawbacks of solar panel financing is the initial investment required. While solar panels can save you money in the long run, the upfront costs can be significant. This can be a barrier for some homeowners who may not have the cash on hand to pay for the system outright.

2. Interest Rates: Just like any other financing option, solar panel loans come with interest rates. Depending on your credit score and the financing option you choose, you may end up paying more for your solar panels in the long run due to interest charges. It's essential to carefully evaluate the terms of the loan to ensure you're getting the best deal possible.

3. Length of Loan: Solar panel financing typically involves taking out a loan that you'll need to pay back over a set period. This means you'll be committed to making monthly payments for several years. While this can help you budget for your solar panels, it's essential to consider whether you're comfortable with this long-term financial commitment.

4. Resale Value: While solar panels can increase the value of your home, some potential buyers may see them as an added expense rather than a benefit. This could potentially make it more challenging to sell your home in the future if the buyer is not interested in taking over your solar panel financing.

5. Maintenance Costs: While solar panels are relatively low maintenance, they do require periodic upkeep to ensure they continue to operate efficiently. You'll need to factor in these maintenance costs when considering the overall cost of your solar panel system.

Despite these potential drawbacks, many homeowners in Tampa find that the benefits of solar panel financing far outweigh the cons. By carefully weighing your options, understanding the terms of the financing agreement, and working with a reputable solar panel provider, you can make an informed decision that aligns with your financial goals and sustainability values. Remember, with careful planning and research, solar panel financing can be a smart investment in your home's future.

Solar panel financing can be a game-changer when it comes to making the switch to renewable energy in Tampa. With the right financing option, you can start saving on your electricity bills while reducing your carbon footprint. Let's delve into the cost savings you can expect with solar panel financing.

Cost Savings with Solar Panel Financing

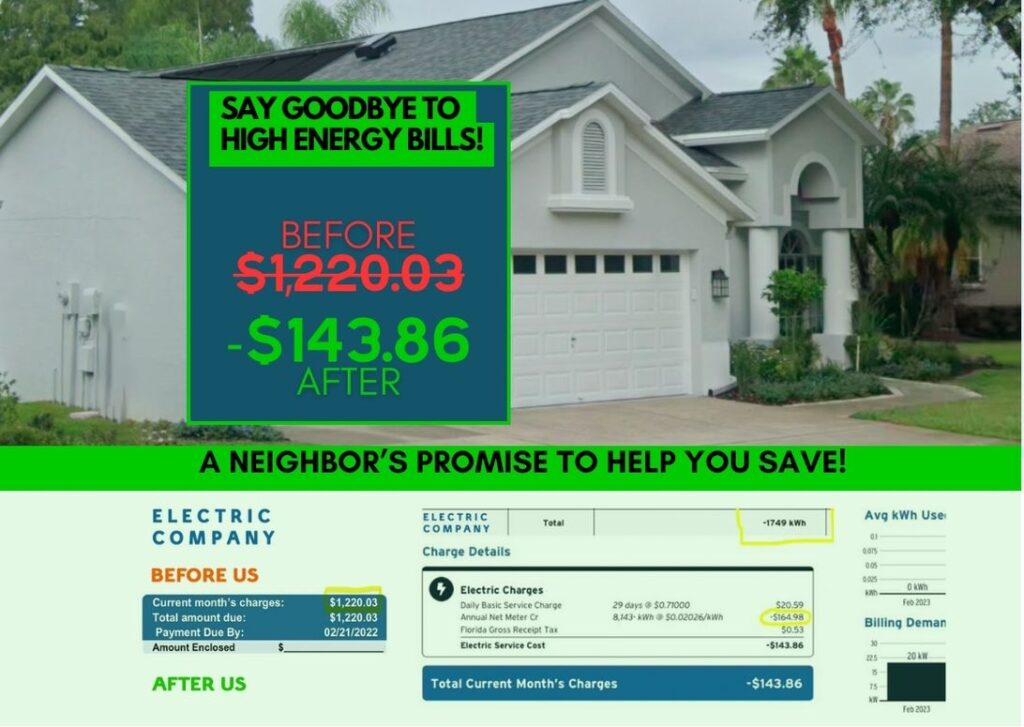

One of the most significant advantages of solar panel financing is the potential for long-term cost savings. While the initial investment in a solar panel system may seem daunting, the savings you will accrue over time can make it well worth the upfront cost. By generating your electricity from the sun, you can significantly reduce your monthly utility bills.

When you finance your solar panel system, you can spread out the cost over several years, making it more affordable and manageable. With financing options like solar loans or solar leases, you can choose a plan that fits your budget and lifestyle. In many cases, the savings on your electricity bills can offset the monthly payments on your solar financing, making it a financially sound decision in the long run.

Moreover, as utility rates continue to rise, your savings with solar panel financing will only increase. By locking in lower electricity costs through solar power, you can shield yourself from future price hikes and enjoy consistent savings year after year. In fact, studies have shown that homeowners with solar panels can save thousands of dollars over the lifespan of their system.

Another benefit of solar panel financing is the potential to earn money through net metering. With net metering, any excess electricity your solar panels generate can be sent back to the grid, earning you credits on your utility bill. This means that not only can you save on your electricity costs, but you may also have the opportunity to earn additional income through your solar panel system.

In addition to direct cost savings, installing solar panels can increase the value of your home. Studies have shown that homes with solar panels sell faster and at a higher price than those without. This means that your investment in solar panel financing can pay off when it comes time to sell your home, providing a return on your initial investment.

Overall, solar panel financing offers a multitude of benefits when it comes to cost savings. By taking advantage of financing options and harnessing the power of the sun, you can enjoy lower electricity bills, increased home value, and a more sustainable lifestyle. So why wait? Start exploring solar panel financing options in Tampa today and reap the benefits of a brighter, greener future.

Government Incentives for Solar Panel Financing in Tampa

Are you considering making the switch to solar energy but concerned about the initial investment? Well, Tampa residents, you're in luck! There are a variety of government incentives available to help you finance your solar panel system and make the transition to clean energy more affordable.

1. Federal Tax Credit

One of the most significant incentives for solar panel financing is the federal Investment Tax Credit (ITC). This credit allows you to deduct a percentage of the cost of installing a solar energy system from your federal taxes. Currently, the ITC offers a 26% credit for systems installed in 2020-2022. This incentive can save you thousands of dollars on your solar panel installation, making it a smart financial decision.

2. State and Local Incentives

In addition to the federal tax credit, many states, cities, and utilities offer their own incentives to encourage homeowners to go solar. In Tampa, you may be eligible for rebates, grants, or other financial incentives that can further reduce the cost of your solar panel system. These incentives vary by location, so be sure to research what is available in your area.

3. Net Metering

Net metering is another valuable incentive for solar panel owners. This policy allows you to sell excess energy generated by your solar panels back to the grid, offsetting your electricity costs. In Tampa, net metering can help you save money on your utility bills and maximize the financial benefits of your solar investment.

4. Property Tax Exemptions

Some states, including Florida, offer property tax exemptions for homeowners who install solar panels. This exemption can reduce the overall cost of your solar panel system by exempting the added value of the panels from property taxes. By taking advantage of this incentive, you can enjoy long-term savings on your solar investment.

5. Solar Renewable Energy Credits (SRECs)

SRECs are tradable certificates that represent the clean energy generated by your solar panels. In some states, including Florida, you can sell these credits to utilities to meet their renewable energy goals. By participating in the SREC market, you can earn additional income from your solar panel system and further offset your initial investment.

By leveraging these government incentives, Tampa residents can make solar panel financing more accessible and affordable. Before investing in a solar energy system, be sure to research the incentives available to you and consult with a solar energy provider to explore your financing options. With the right incentives and financing plan, you can enjoy the many benefits of clean, renewable energy while saving money in the process.

VI. Choosing the Right Financing Option for Your Solar Panel System

So, you've decided to take the leap and invest in a solar panel system for your home in Tampa. Congratulations! This decision not only benefits the environment but also has the potential to save you money in the long run. However, before you can start enjoying the benefits of solar energy, you need to figure out the best financing option for your solar panel system.

When it comes to financing your solar panel system, there are a few options to consider. Let's take a look at some of the most common choices:

1. Cash Purchase: If you have the financial means to pay for your solar panel system upfront, this may be the best option for you. By paying in cash, you can avoid interest charges and potentially save more money in the long term.

2. Solar Loan: Many financial institutions offer loans specifically for solar panel installations. These loans often have lower interest rates than traditional loans, making them an attractive option for homeowners looking to go solar.

3. Solar Lease: With a solar lease, you can “rent” a solar panel system for a fixed monthly payment. While you won't own the system, you can still benefit from lower electricity bills.

4. Power Purchase Agreement (PPA): Similar to a solar lease, a PPA allows you to “buy” the electricity produced by the solar panel system at a fixed rate. This can be a good option if you don't want to deal with the upfront costs of installing solar panels.

When choosing the right financing option for your solar panel system, consider factors such as your budget, financial goals, and long-term energy savings. It's essential to weigh the pros and cons of each option before making a decision.

Here are a few tips to help you choose the right financing option:

– Evaluate Your Budget: Determine how much you can afford to spend on your solar panel system. This will help you narrow down your financing options.

– Research Different Financing Options: Take the time to research different financing options available to you. Compare interest rates, terms, and conditions to find the option that best suits your needs.

– Consider Government Incentives: Don't forget to take advantage of any government incentives or rebates available for solar panel installations. These incentives can help offset the cost of your system.

– Consult with Solar Experts: If you're unsure about which financing option is right for you, consult with solar experts or financial advisors who can provide you with guidance based on your specific situation.

By choosing the right financing option for your solar panel system, you can make the most out of your investment and enjoy the benefits of clean, renewable energy for years to come. Remember, the key is to do your research, weigh your options, and make an informed decision that aligns with your goals and budget.

Steps to Take to Secure Solar Panel Financing in Tampa

So, you've decided to take the plunge and invest in solar panels for your home in Tampa. Congratulations on this environmentally friendly and cost-saving decision! Now comes the important step of securing financing for your solar panel system. Here are some steps to help you navigate through the process:

- Evaluate Your Financial Situation: Before diving into financing options, take a close look at your budget and financial goals. Understand how much you can afford to invest in solar panels and how much you can save in the long run.

- Research Financing Options: There are various financing options available for solar panel installations, including solar loans, solar leases, and power purchase agreements. Research these options thoroughly to find the best fit for your financial situation.

- Compare Rates and Terms: Once you've narrowed down your financing options, compare rates, terms, and incentives offered by different lenders or solar financing companies. Look for low-interest rates, favorable repayment terms, and any government incentives available in Tampa.

- Check for Government Incentives: Speaking of government incentives, make sure to check for any local, state, or federal incentives available for solar panel installations in Tampa. These incentives can significantly reduce the overall cost of your solar panel system.

- Get Multiple Quotes: Before finalizing your financing decision, get multiple quotes from reputable solar panel installers in Tampa. Compare quotes, warranties, and quality of equipment to ensure you're getting the best value for your investment.

- Review and Sign the Agreement: Once you've selected a financing option and chosen a solar panel installer, review the agreement carefully. Make sure you understand all terms and conditions before signing on the dotted line.

- Submit Financing Documents: Depending on the financing option you choose, you may need to submit certain documents to secure funding for your solar panel system. Be prepared to provide financial statements, credit history, and other relevant information as requested.

- Monitor Installation Progress: After securing financing, monitor the installation progress closely to ensure the work is completed as agreed upon. Keep communication open with your solar panel installer and financing provider throughout the process.

- Enjoy Your Solar Savings: Once your solar panel system is up and running, sit back and enjoy the benefits of solar energy. Not only will you be reducing your carbon footprint, but you'll also be saving money on your utility bills in the long run.

By following these steps, you'll be well on your way to securing financing for your solar panel system in Tampa. Remember, investing in solar panels is not only a smart financial decision but also a positive step towards a more sustainable future. Happy solar panel financing!