Introduction to Solar Panels in Tampa

Are you considering installing solar panels in your home in Tampa? You're making a great choice for the environment and your wallet! Solar panels are a fantastic way to harness the power of the sun to generate clean, renewable energy for your household. In this guide, we'll walk you through the benefits of solar panels, the savings they can bring, and how you can take advantage of federal tax credits to make your investment even more economical.

Solar panels have become increasingly popular in Tampa, thanks to the abundant sunshine that Florida enjoys throughout the year. By installing solar panels on your roof, you can significantly reduce your reliance on traditional electricity sources, lower your utility bills, and shrink your carbon footprint. Plus, with advancements in technology, solar panels are more efficient and affordable than ever before, making them a smart choice for homeowners looking to go green.

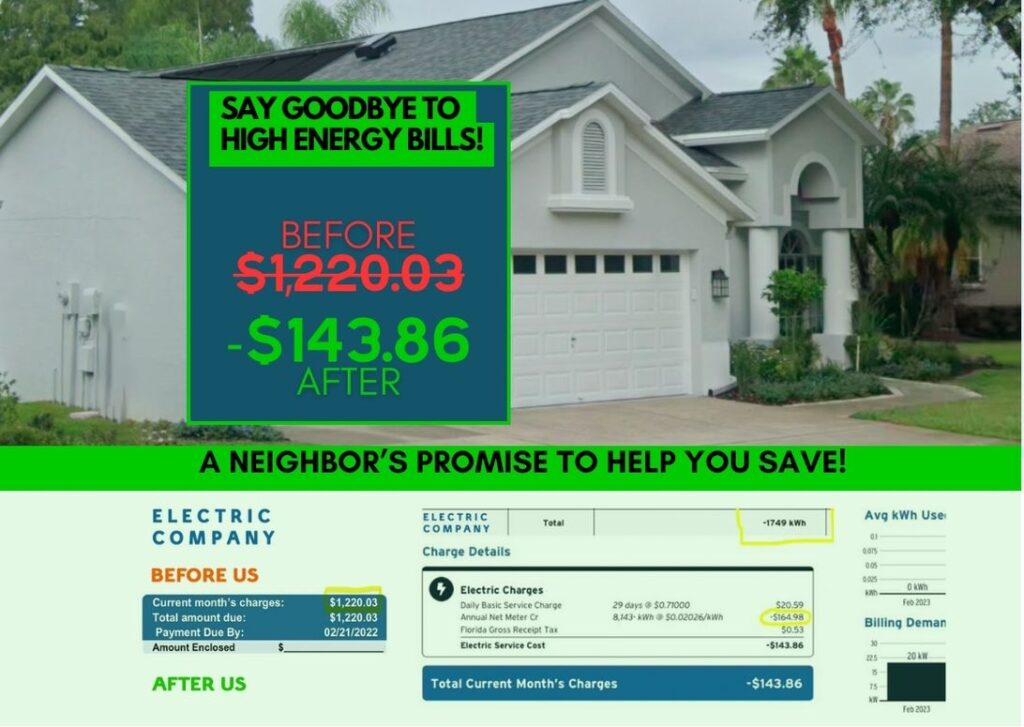

In addition to the environmental benefits, solar panels can also provide substantial financial savings. By generating your electricity from the sun, you can significantly decrease your monthly utility bills. Depending on the size of your system and your energy usage, you may even be able to eliminate your electricity bill entirely! Imagine the satisfaction of knowing that you're powering your home with clean, renewable energy while also saving money.

But the benefits don't stop there. When you install solar panels in Tampa, you may be eligible for federal tax credits that can further reduce the cost of your investment. The federal government offers several tax incentives to encourage homeowners to switch to solar energy, making it an even more attractive option for eco-conscious individuals.

In the following sections, we'll delve into the details of federal tax credits, including the Investment Tax Credit (ITC) and the Residential Energy Efficient Property Credit. We'll also explore additional incentives available in Florida to help you maximize your savings and make the most of your solar panel installation. By taking advantage of these tax credits and incentives, you can make your transition to solar power even more affordable and rewarding.

So, if you're thinking about installing solar panels in Tampa, you're on the right track! Not only will you be reducing your carbon footprint and contributing to a cleaner environment, but you'll also be saving money and enjoying the benefits of renewable energy. Stay tuned for more information on how federal tax credits can make your solar panel investment even more cost-effective. Get ready to harness the power of the sun and take control of your energy future!

Federal Tax Credit Overview

One of the most significant benefits of installing solar panels in your Tampa home is the federal tax credit available to help offset the initial cost. This tax credit, known as the Investment Tax Credit (ITC), allows homeowners to deduct a percentage of the cost of installing a solar energy system from their federal taxes. It's like getting a discount on your solar panels from the government!

Here's how it works: when you install a solar panel system, you can claim 26% of the total cost as a tax credit on your federal tax return. So, for example, if your solar panel system costs $10,000 to install, you could receive a tax credit of $2,600 (26% of $10,000). This credit is a dollar-for-dollar reduction in the amount of federal income tax you owe, making it a valuable incentive for investing in solar energy.

What makes the ITC even more appealing is that there is no cap on the amount you can receive in tax credits. As long as you own your solar panel system and have enough tax liability to claim the credit, you can continue to benefit from it year after year.

It's important to note that the ITC percentage is set to decrease in the coming years, so now is a great time to take advantage of this incentive. In 2023, the tax credit is scheduled to drop to 22%, and it will expire for residential installations in 2024. So, the sooner you go solar, the more you can save!

Plus, the ITC can be combined with other incentives, such as the Residential Energy Efficient Property Credit, to maximize your savings. By leveraging these tax credits, you can make solar energy even more affordable for your home.

When considering installing solar panels in Tampa, be sure to factor in the federal tax credit and consult with a tax professional to fully understand how it can benefit you. It's a fantastic way to make renewable energy a cost-effective and environmentally friendly choice for your home!

Investment Tax Credit (ITC)

One of the most significant financial incentives for investing in solar panels is the Investment Tax Credit (ITC). This credit allows you to deduct a portion of the cost of installing a solar energy system from your federal taxes. It’s like getting a discount on your solar panel system purchase!

Here’s how it works: when you install a solar panel system on your property, you can claim 26% of the total cost of the system as a credit on your federal taxes. For example, if your solar panel system costs $10,000 to install, you could get a tax credit of $2,600, reducing your tax bill.

The best part about the ITC is that there is no cap on the credit amount, so you can claim the full 26% of your system’s cost, regardless of how much it costs. This can result in significant savings for homeowners looking to invest in renewable energy.

However, it’s essential to note that the ITC percentage is set to decrease in the coming years. In 2023, the credit will drop to 22%, making it even more valuable to take advantage of this incentive sooner rather than later.

Another crucial point to keep in mind is that the ITC can only be claimed by individuals who own their solar panel system. If you choose to lease your system through a third-party provider, you won’t be eligible for the credit. So, owning your system is not only financially beneficial in the long run but also allows you to take advantage of the ITC.

When it comes to claiming the Investment Tax Credit, the process is relatively straightforward. You’ll need to complete IRS Form 5695 when filing your taxes and provide information about your solar panel system’s cost and installation date. Make sure to keep all receipts and documentation related to your solar panel system handy to support your claim.

Overall, the ITC is a fantastic incentive for homeowners considering solar panel installation. Not only does it make renewable energy more affordable, but it also contributes to a greener and more sustainable future for our planet. So, if you’re thinking about going solar, don’t miss out on the opportunity to take advantage of the Investment Tax Credit!

Are you considering installing solar panels in your home in Tampa? It's a fantastic idea that not only helps the environment but also saves you money in the long run. In addition to the benefits of solar energy, there are various incentives and tax credits available to homeowners in Florida who choose to go solar. One of these incentives is the Residential Energy Efficient Property Credit.

Residential Energy Efficient Property Credit

The Residential Energy Efficient Property Credit is a federal tax credit that allows homeowners to claim a percentage of the cost of qualified energy-efficient improvements made to their homes, including solar panels. This credit applies to both primary and secondary residences, making it a great incentive for homeowners looking to invest in renewable energy.

For solar panel installations, homeowners can claim a credit of up to 26% of the total cost of the system. This credit covers the equipment and installation expenses, making it a substantial financial benefit for those looking to go solar. The credit has been extended until the end of 2023, providing homeowners with more time to take advantage of this incentive.

It's important to note that the Residential Energy Efficient Property Credit has no maximum limit, allowing homeowners to claim the full 26% credit for their solar panel system. This can result in significant savings on your federal taxes, making the switch to solar even more appealing.

Claiming the Residential Energy Efficient Property Credit is relatively straightforward. You will need to file IRS Form 5695 along with your annual tax return to claim the credit. Make sure to keep all documentation related to your solar panel installation, including receipts and proof of purchase, as you may need to provide this information when filing for the credit.

As with any tax-related matter, it's essential to consult with a tax professional to ensure you are maximizing your savings and taking full advantage of available incentives. They can provide guidance on how to properly claim the Residential Energy Efficient Property Credit and answer any questions you may have about the process.

By taking advantage of the Residential Energy Efficient Property Credit, you can make your solar panel installation even more cost-effective and beneficial. Not only will you be reducing your carbon footprint and contributing to a cleaner environment, but you'll also be saving money on your taxes. It's a win-win situation that makes investing in solar energy a smart choice for Tampa homeowners.

Solar Panel Incentives in Florida

As you consider installing solar panels in your Tampa home, it's essential to explore the various incentives that can help offset the initial costs and maximize your savings in the long run. Florida offers a range of incentives that can make going solar even more appealing.

1. Net Metering: Florida has a net metering policy that allows homeowners with solar panels to receive credit for the excess electricity they generate and send back to the grid. This means you can offset your electricity costs by producing your electricity during the day and using it at night or on cloudy days.

2. Property Tax Exemption: In Florida, solar panels are exempt from property taxes, which means you won't see an increase in your property tax bill when you install solar panels on your home. This exemption can result in significant savings over the life of your solar panel system.

3. Sales Tax Exemption: Florida offers a sales tax exemption on the purchase of solar energy systems, including solar panels, inverters, and batteries. This exemption can help reduce the upfront costs of installing solar panels, making them more affordable for homeowners.

4. Local Utility Rebates: Some utility companies in Florida offer rebates to homeowners who install solar panels. These rebates can vary depending on the utility company and the size of your solar panel system, but they can provide additional financial incentives to go solar.

5. PACE Financing: Property Assessed Clean Energy (PACE) financing is available in some areas of Florida and allows homeowners to finance the cost of their solar panel system through their property taxes. PACE financing can provide a low-interest way to pay for your solar panels over time, making them more accessible to a wider range of homeowners.

When considering these incentives, it's essential to consult with a solar energy professional to determine which ones you qualify for and how they can benefit your specific situation. By taking advantage of these incentives, you can make going solar in Florida even more cost-effective and environmentally friendly.

Remember, the solar panel incentives in Florida are subject to change, so it's crucial to stay informed about the latest programs and policies that can help you make the most of your solar investment. By working with a trusted solar energy provider and staying up-to-date on available incentives, you can maximize your savings and enjoy the many benefits of solar energy for years to come.

Qualifying for Tax Credits

So you're thinking about making the switch to solar energy in Tampa, and you've heard about the federal tax credits that can help offset the cost. That's great news! But how exactly do you qualify for these tax credits?

First and foremost, in order to be eligible for the Investment Tax Credit (ITC) and the Residential Energy Efficient Property Credit, you must own the solar panel system that is being installed. This means if you are leasing the system or participating in a power purchase agreement (PPA), you will not be eligible for these tax credits.

Next, your solar panel system must be installed and in operation by December 31, 2023, to qualify for the full 26% ITC. The ITC is set to decrease to 22% in 2023 and drop to 10% for commercial projects and 0% for residential projects in 2024. So, the sooner you make the switch to solar, the more you can save!

Additionally, in order to claim the Residential Energy Efficient Property Credit, your solar panel system must meet certain efficiency and safety standards. Make sure to work with a reputable solar installer who uses high-quality equipment that meets these standards to ensure your system is eligible for this credit.

It's also important to note that these tax credits are non-refundable, meaning they can only be used to offset your tax liability. If you do not owe enough in taxes to fully utilize the credits in one year, you can roll over the remaining credits to future years.

To claim these tax credits, you will need to file IRS Form 5695 along with your federal tax return. Make sure to keep all receipts and documentation related to your solar panel installation in case you are audited by the IRS.

If you are unsure about whether you qualify for these tax credits or how to properly claim them, it's always a good idea to consult with a tax professional. They can help you navigate the complex tax laws and ensure you are maximizing your savings.

By taking advantage of these federal tax credits, you can make the switch to solar energy more affordable and environmentally friendly. So don't wait, start exploring your solar options today and see how much you can save on your taxes while reducing your carbon footprint!

Having decided to invest in solar panels for your home in Tampa, you're on the right path towards energy efficiency and cost savings. However, navigating the world of tax credits and incentives can be overwhelming.

That's where consulting with a tax professional can make a world of difference.

1. Expert Advice: Tax laws and incentives surrounding solar panel installation are constantly changing. A tax professional specializing in renewable energy can provide you with the most up-to-date information and guidance tailored to your specific situation.

2. Maximizing Savings: Tax professionals have the expertise to ensure you are taking full advantage of all available tax credits and incentives. They can help you navigate complex tax forms and calculations to maximize your savings.

3. Avoiding Costly Mistakes: Filing for tax credits related to solar panel installation requires attention to detail and accuracy. A tax professional can help you avoid costly mistakes that could result in missed opportunities for savings.

4. Personalized Recommendations: Every homeowner's financial situation is unique. A tax professional can provide personalized recommendations based on your income, tax liability, and other factors to help you make the most of available tax credits.

5. Peace of Mind: By consulting with a tax professional, you can have peace of mind knowing that your tax filing related to solar panel installation is in expert hands. This allows you to focus on enjoying the benefits of your solar panel system without the stress of dealing with complex tax matters.

In conclusion, consulting with a tax professional is a smart investment when it comes to maximizing your tax savings related to solar panel installation. Their expertise, personalized advice, and attention to detail can help ensure you make the most of available tax credits and incentives. So, before you dive into the world of tax forms and calculations, consider reaching out to a tax professional to guide you through the process and help you reap the full benefits of going solar in Tampa.