Understanding Solar Panel Financing

So, you've made the decision to embrace sustainable living and are considering installing solar panels on your home in Tampa. Congratulations! Not only will you be reducing your carbon footprint, but you'll also be taking a step towards energy independence. However, the thought of financing such a project can be daunting. Don't worry; I'm here to guide you through the process.

When it comes to solar panel financing, there are various options available to suit different budgets and preferences. Understanding these options is crucial in making an informed decision that aligns with your financial goals.

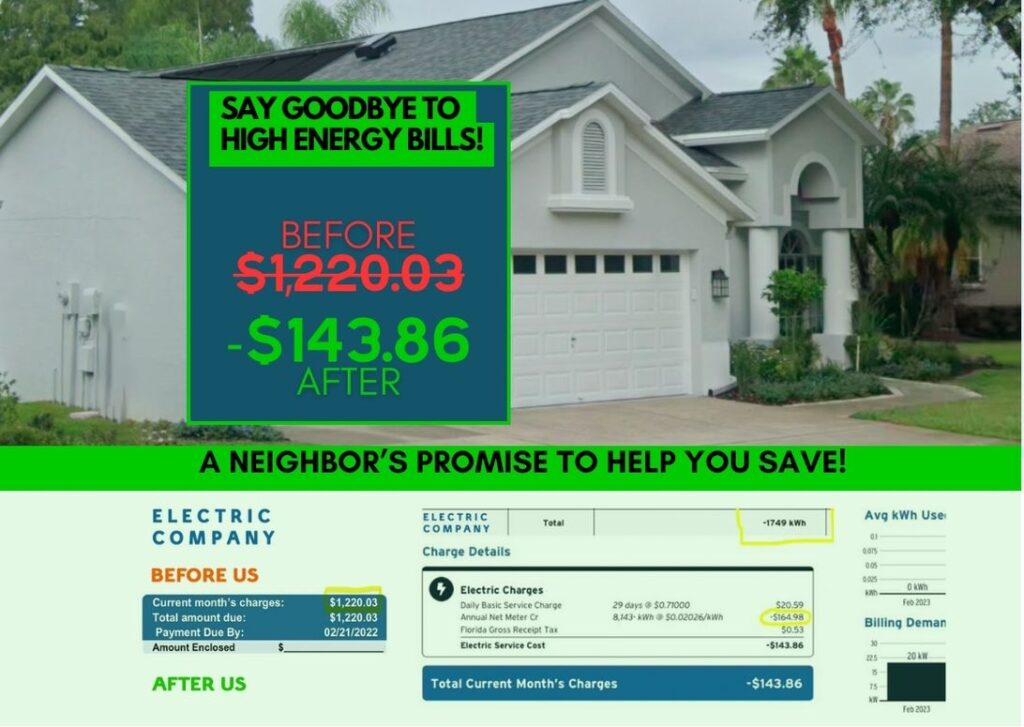

First and foremost, it's essential to recognize the long-term benefits of investing in solar panels. Not only will you lower your electricity bills significantly, but you may also be eligible for tax incentives and rebates that can further offset the initial costs of installation. Plus, with the rising costs of traditional energy sources, solar panels can provide a stable and predictable energy source for years to come.

One of the key advantages of solar panel financing is that it allows you to start saving money from day one. While the initial investment might seem high, the long-term savings on your energy bills can quickly recoup those costs. Additionally, financing options such as solar loans and leases make it easier for homeowners to afford solar panel installations without having to pay the full amount upfront.

When exploring different financing options, it's crucial to consider factors such as interest rates, loan terms, and down payment requirements. Some financing plans offer fixed monthly payments, while others may fluctuate based on the amount of energy your solar panels generate. By comparing these options and understanding the terms and conditions, you can choose a financing plan that best suits your financial situation.

Furthermore, federal and state incentives can make solar panel installation even more affordable. Programs such as the Federal Solar Investment Tax Credit (ITC) and the Florida Solar Energy Systems Incentive Program provide financial incentives for homeowners who invest in solar energy. These incentives can significantly reduce the overall cost of installation and help you achieve a quicker return on your investment.

As you navigate the world of solar panel financing, keep in mind that choosing the right plan is essential. Consider factors such as your budget, energy consumption, and long-term goals when selecting a financing option. Remember, the goal is not only to save money but also to contribute to a more sustainable future for yourself and future generations.

Stay tuned as we delve deeper into the various financing options available for solar panel installation in Tampa, explore success stories of homeowners who have made the switch to solar energy, and provide expert tips on how to make the most of your investment. Get ready to take the first step towards a brighter, cleaner future with solar panel financing!

Investing in solar panels in Tampa can bring numerous benefits to your home and your wallet. From reducing your electricity bills to increasing the value of your property, solar panels offer a sustainable and cost-effective solution to powering your home.

Benefits of Investing in Solar Panels in Tampa

- Energy Savings: By harnessing the power of the sun, solar panels can significantly reduce your monthly electricity bills. In Tampa, where sunny days are abundant, you can generate ample energy to power your home.

- Increased Property Value: Homes with solar panels are more attractive to buyers and often sell for a higher price. Installing solar panels can enhance the value of your property and make it more appealing on the real estate market.

- Environmentally Friendly: Solar energy is a clean and renewable source of power that reduces your carbon footprint. By choosing solar panels, you can contribute to a healthier planet and help combat climate change.

- Tax Incentives: The federal government offers a solar Investment Tax Credit (ITC) that allows you to deduct a percentage of the cost of installing solar panels from your federal taxes. This incentive can significantly offset the initial investment in solar energy.

- Energy Independence: With solar panels, you can generate your own electricity and reduce your reliance on the grid. This independence gives you greater control over your energy consumption and provides peace of mind during power outages.

Investing in solar panels in Tampa is not only a smart financial decision but also a sustainable choice for the environment. With a range of benefits from energy savings to increased property value, solar panels can transform your home into an eco-friendly and cost-effective powerhouse.

Exploring Different Financing Options Available

So, you've decided to take the leap and invest in solar panels for your home in Tampa – great choice! Now comes the next important decision: how will you finance this eco-friendly upgrade? Luckily, there are several financing options available to help you make the switch to solar power without breaking the bank.

1. Solar Loan

One popular option is to take out a solar loan specifically designed for financing solar panel installations. These loans typically have low-interest rates and flexible terms, making them a cost-effective way to finance your solar project. With a solar loan, you can spread out the cost of your system over time, making it more manageable for your budget.

2. Solar Lease

If you don't want to deal with the upfront costs of purchasing a solar panel system, a solar lease might be the perfect solution for you. With a solar lease, you essentially rent the solar panels from a third-party provider who installs and maintains the system. While you won't own the system, you can still enjoy the benefits of solar energy without the hefty initial investment.

3. Power Purchase Agreement (PPA)

Similar to a solar lease, a power purchase agreement (PPA) allows you to benefit from solar energy without owning the panels. With a PPA, a third-party provider installs solar panels on your property and sells you the electricity they produce at a fixed rate. This can be a great option if you want to save on your energy bills without dealing with the maintenance and ownership of the system.

4. Cash Purchase

If you have the financial means, paying for your solar panel system upfront with cash can be a smart investment. While this option requires a larger initial investment, you can enjoy significant long-term savings on your energy bills and potentially even generate income through incentives like net metering. Plus, you'll own the system outright and can benefit from the tax credits and incentives that come with solar ownership.

5. Home Equity Loan or Line of Credit

Another financing option to consider is using a home equity loan or line of credit to finance your solar panel installation. By leveraging the equity in your home, you can secure a low-interest loan to cover the cost of going solar. This can be a smart way to finance your solar project while taking advantage of tax-deductible interest payments.

When exploring these financing options, it's essential to consider your financial situation, energy goals, and long-term savings potential. By weighing the pros and cons of each option and consulting with solar professionals, you can choose the financing plan that best fits your budget and energy needs. Remember, investing in solar panels is not just a financial decision – it's an investment in a greener, more sustainable future for you and your community.

Installing solar panels in your home in Tampa can be a game-changer, not only for the environment but also for your wallet. The initial investment may seem daunting, but with the right financing options, you can make the switch to solar energy without breaking the bank. Let's delve into some federal and state incentives that can help offset the costs of solar panel installation.

**Federal Tax Credit:** One of the most significant incentives for installing solar panels is the federal investment tax credit (ITC). The ITC allows you to deduct a percentage of the cost of installing a solar energy system from your federal taxes. As of 2021, the ITC covers 26% of the total cost of installation, making solar energy more affordable for homeowners. However, it's essential to note that the tax credit is set to decrease to 22% in 2023, so now is the perfect time to take advantage of this incentive.

**State Rebates and Incentives:** In addition to the federal tax credit, many states offer their own rebates and incentives for installing solar panels. In Florida, you may be eligible for the Property Assessed Clean Energy (PACE) program, which allows homeowners to finance energy efficiency and renewable energy upgrades through a special assessment on their property. This program can help you finance the upfront costs of solar panel installation while making energy-efficient upgrades to your home.

**Net Metering:** Another crucial incentive to consider is net metering, which allows you to sell excess electricity generated by your solar panels back to the grid. With net metering, you can offset your electricity bills and even earn credits for the excess electricity you produce. This can significantly reduce your overall energy costs and make your investment in solar panels even more worthwhile.

**Solar Renewable Energy Credits (SRECs):** Some states, including Florida, offer Solar Renewable Energy Credits (SRECs) as an incentive for producing solar energy. SRECs are tradable credits that represent the environmental benefits of generating electricity from solar energy. By selling these credits, you can earn additional income on top of the savings you already receive from producing your electricity.

When considering solar panel financing, it's crucial to explore all the available incentives and financing options to make the most informed decision for your budget. By taking advantage of federal and state incentives, you can make the switch to solar energy more affordable and sustainable for your home in Tampa. Don't hesitate to reach out to a trusted solar panel provider to learn more about the incentives available to you and choose the right financing plan that fits your needs.

When it comes to choosing the right financing plan for your solar panel system, there are several key factors to consider. Here are some tips to help you navigate the process and make an informed decision:

1. Assess Your Budget:

Before diving into the world of solar panel financing, take a close look at your budget. Determine how much you can comfortably afford to invest in a solar energy system without straining your finances. Consider your monthly income, expenses, and savings to get a clear picture of what you can realistically allocate towards solar panels.

2. Research Financing Options:

There are various financing options available for solar panel installation, including solar loans, leases, power purchase agreements (PPAs), and cash purchases. Each option has its pros and cons, so it's essential to research and compare them to find the best fit for your needs. Look into interest rates, terms, incentives, and other factors that may impact your decision.

3. Consider Incentives and Rebates:

Before finalizing your financing plan, explore federal and state incentives for solar panel installation. These incentives can significantly reduce the upfront cost of going solar and make it more affordable in the long run. Look for tax credits, rebates, and other financial incentives that can help offset the cost of your solar energy system.

4. Evaluate Long-Term Savings:

While upfront costs may seem daunting, remember that investing in solar panels can lead to significant long-term savings on your energy bills. Calculate the potential savings over the lifespan of your solar panel system to see the financial benefits of going solar. Consider factors such as energy production, utility rates, and maintenance costs to get a comprehensive view of your savings potential.

5. Consult with Solar Energy Experts:

Don't hesitate to seek advice from solar energy experts or reputable solar companies in Tampa. They can provide valuable insights into financing options, incentives, and the best solar panel systems for your home. Consulting with professionals can help you make an informed decision and ensure a smooth and successful solar panel installation process.

6. Review and Compare Offers:

Once you've done your research and consulted with experts, review and compare financing offers from different providers. Pay attention to terms, fees, warranties, and customer reviews to choose a financing plan that aligns with your budget and goals. Don't rush the decision-making process – take your time to find the best financing option for your needs.

By following these tips and considering your budget, incentives, long-term savings, and expert advice, you can choose the right financing plan for your solar panel system in Tampa. Investing in solar energy is a smart decision that can benefit both your wallet and the environment, so take the time to find the best financing option for your home.

When it comes to investing in solar panel systems for your home in Tampa, financing plays a crucial role in making this sustainable energy solution a reality. Let's delve into some success stories of individuals who have taken the leap towards solar energy independence through different financing options.

Case Studies: Success Stories of Solar Panel Financing in Tampa

- Case Study 1: The Smith Family

- Case Study 2: Sarah and John

- Case Study 3: Mark's Solar Power Purchase Agreement (PPA)

The Smith family in Tampa decided to go solar to reduce their carbon footprint and save on their electricity bills. They opted for a solar lease, where they pay a fixed monthly fee to the solar provider for the system installed on their roof. With no upfront costs, the Smiths were able to start generating clean energy right away. Over time, they noticed a significant drop in their electricity bills, allowing them to save money while contributing to a greener planet.

Sarah and John, residents of Tampa, wanted to own their solar panel system outright. They chose a solar loan to finance their installation. By taking advantage of the federal tax credits and state incentives available, they were able to offset a large portion of the upfront costs. With a low-interest loan, they were able to make manageable monthly payments while reaping the benefits of reduced energy bills and increased home value.

Mark, a homeowner in Tampa, opted for a Power Purchase Agreement (PPA) to install solar panels on his property. Under this arrangement, Mark pays for the electricity produced by the solar panels at a lower rate than his utility company's prices. This allowed Mark to lock in lower energy costs and protect himself against future utility rate hikes. With no upfront costs, Mark was able to go solar with ease and start saving money from day one.

These case studies demonstrate the diverse financing options available for homeowners in Tampa looking to harness the power of solar energy. Whether you choose a solar lease, loan, or PPA, there is a financing solution that can suit your budget and energy goals.

Before committing to a financing plan, it's essential to research and compare different options to find the best fit for your financial situation. Consider factors such as upfront costs, monthly payments, interest rates, and potential savings on your electricity bills. Consulting with solar experts and financial advisors can also help you make an informed decision.

By exploring the success stories of others who have embraced solar panel financing in Tampa, you can gain valuable insights and inspiration to take the first step towards a more sustainable and cost-effective energy future for your home.

Remember, with the right financing plan in place, you can enjoy the benefits of solar energy while making a positive impact on the environment and your wallet. Start your journey towards solar energy independence today!

Conclusion: Taking the First Step Towards Solar Energy Independence

Congratulations on considering the exciting journey towards solar energy independence for your home in Tampa! The decision to invest in solar panels is not only beneficial for the environment but also for your wallet in the long run. As you take the first step towards harnessing the power of the sun, there are a few key points to keep in mind to ensure a smooth and successful transition to solar energy.

Research is Key

Before diving into the world of solar panel financing, it's crucial to do your homework. Research different financing options available in Tampa, compare interest rates and terms, and determine which plan aligns best with your budget and needs. Understanding the intricacies of solar panel financing will empower you to make informed decisions throughout the process.

Consult with Experts

Don't hesitate to reach out to solar energy experts in Tampa for guidance and advice. They can provide valuable insights into the financing options available, help you navigate federal and state incentives, and offer personalized recommendations based on your specific circumstances. Consulting with professionals will ensure that you make the most out of your investment in solar panels.

Consider Long-Term Savings

While the initial cost of installing solar panels may seem daunting, it's essential to recognize the long-term savings and benefits they offer. By generating your own clean energy, you can significantly reduce your electricity bills and even earn money through net metering programs. Keep in mind that solar panels are a smart investment that pays off in the form of lower energy costs and increased home value.

Stay Informed on Incentives

Make sure to stay up-to-date on federal and state incentives for solar panel installation in Tampa. From tax credits to rebates, there are numerous financial perks available to help offset the upfront costs of going solar. By taking advantage of these incentives, you can make your transition to solar energy even more cost-effective and rewarding.

Start Your Solar Journey Today

Now that you're equipped with valuable insights and tips on solar panel financing, it's time to take the next step towards a sustainable and energy-efficient home. By choosing the right financing plan, leveraging incentives, and working with experts, you can embark on a successful solar energy journey in Tampa. Embrace the power of the sun and enjoy the benefits of clean, renewable energy for years to come!