Understanding Solar Panel Financing Options

So, you're thinking about going solar to power your home and reduce your electricity bills? That's a fantastic decision! Solar energy is clean, renewable, and can save you money in the long run. But before you jump into installing solar panels on your rooftop, it's essential to understand the different financing options available to make this investment more affordable.

When it comes to financing solar panels, you have several choices depending on your financial situation and preferences. Here are some common options to consider:

- Cash Purchase: If you have the financial means, paying for your solar panel system upfront may be the most cost-effective option. While the initial investment can be significant, you'll see a quicker return on investment through energy savings and potential tax incentives.

- Solar Loans: Many financial institutions offer solar loans specifically designed to help homeowners finance their solar panel installations. These loans typically have low-interest rates and flexible payment terms, making them a popular choice for those who prefer not to pay in cash.

- Leasing or Power Purchase Agreements (PPAs): With a solar lease or PPA, you don't own the solar panels on your roof, but rather pay a fixed monthly fee for the electricity they generate. While this option requires little to no upfront cost, you may not be eligible for certain tax incentives, and the savings may be lower compared to owning the system.

- Home Equity Loans: If you have equity in your home, you can consider taking out a home equity loan or line of credit to finance your solar panel system. This option allows you to borrow against the value of your home while potentially deducting the interest from your taxes.

Each financing option has its pros and cons, so it's crucial to evaluate your financial goals and preferences before making a decision. Consider factors like your budget, credit score, available incentives, and long-term energy savings to determine the best financing plan for your solar panel system.

Before committing to any financing option, it's advisable to consult with a reputable solar installer or financial advisor who can help you navigate the complexities of solar panel financing. They can provide tailored recommendations based on your unique situation and guide you towards the most suitable option for your needs.

By understanding the various solar panel financing options available, you can make an informed decision that aligns with your financial goals and environmental aspirations. So, take the time to explore these options and choose the one that best fits your budget and preferences. Your journey to cleaner, more affordable energy starts with the right financing plan!

Benefits of Financing Solar Panels in Tampa

Are you considering making the switch to solar energy but feeling uncertain about the financial aspect? Fear not, as financing your solar panels in Tampa can offer you a plethora of benefits that make the investment well worth it. Let's delve into some of the advantages of opting for solar panel financing:

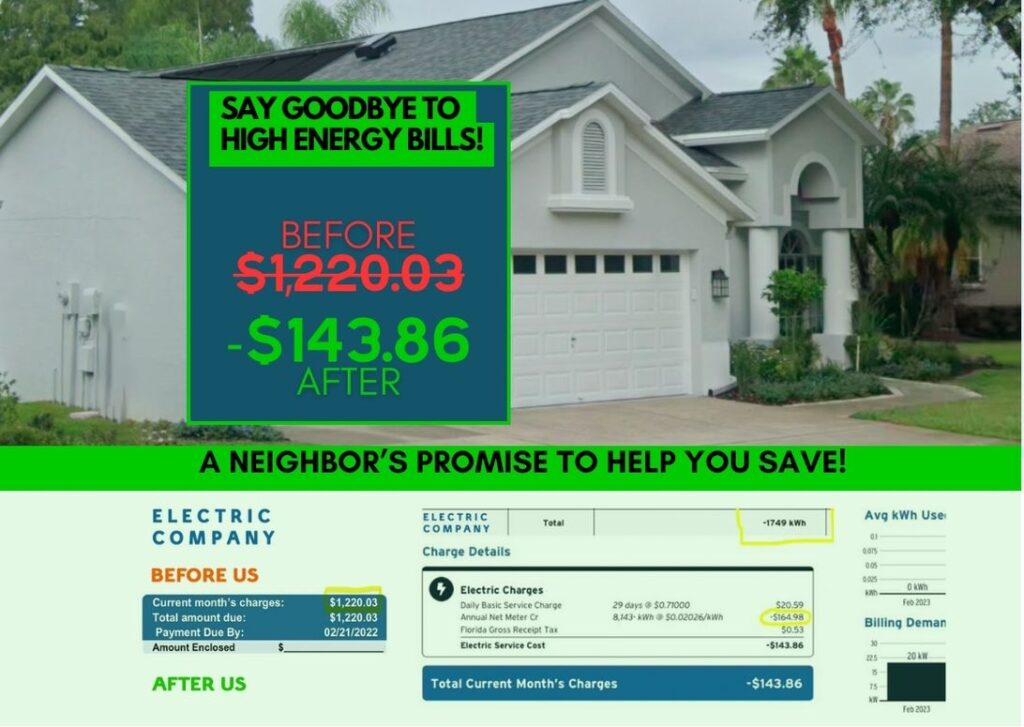

- Immediate Savings: By financing your solar panels, you can start saving money on your electricity bills from day one. With lower monthly payments compared to traditional utility bills, you'll notice the difference in your expenses almost immediately.

- Increased Home Value: Solar panels are known to increase the value of your home. By investing in a solar panel system, you're not only saving money on energy costs but also boosting the overall value of your property. This is a long-term investment that pays off both now and in the future.

- Environmental Impact: By harnessing the power of the sun, you're reducing your carbon footprint and contributing to a cleaner, greener environment. Financing your solar panels allows you to make a positive impact on the planet without breaking the bank.

- Tax Incentives and Rebates: In Tampa, there are various tax incentives, rebates, and other financial incentives available for homeowners who install solar panels. By financing your solar system, you can take advantage of these benefits and maximize your savings.

- Energy Independence: With solar panels, you're no longer at the mercy of fluctuating utility prices. By generating your own clean energy, you can achieve a greater sense of independence and control over your energy usage.

These are just a few of the many benefits of financing your solar panels in Tampa. Not only do you save money and increase the value of your home, but you also contribute to a more sustainable future for yourself and the planet. So, if you're considering making the switch to solar energy, financing your solar panels may be the perfect solution for you.

Exploring Different Financing Programs Available

When it comes to financing your solar panel system in Tampa, you have several options to choose from. Understanding the different financing programs available can help you make an informed decision that suits your financial situation and goals. Here are some common financing programs to consider:

Solar Loans:

Solar loans are a popular financing option that allows you to borrow money to purchase a solar panel system. These loans typically have competitive interest rates and flexible repayment terms. With a solar loan, you can own your solar panel system outright and benefit from the savings on your electricity bills.

Power Purchase Agreements (PPAs):

PPAs are another common financing option where a third-party provider installs and maintains the solar panel system on your property. In exchange, you agree to purchase the electricity produced by the system at a fixed rate. PPAs are a great option for homeowners who want to go solar without any upfront costs.

Leases:

Solar leases involve renting a solar panel system from a third-party provider for a fixed monthly fee. While you won't own the system with a lease, you can still benefit from the clean energy it produces and potential savings on your electricity bills. Leases are a good option for those who prefer a low upfront investment.

Incentives and Rebates:

Don't forget to explore the various incentives and rebates available for solar panel installations in Tampa. Federal, state, and local incentives can help lower the overall cost of your solar panel system, making it more affordable. Be sure to take advantage of these programs to maximize your savings.

Home Equity Loans or Lines of Credit:

If you have equity in your home, you may also consider using a home equity loan or line of credit to finance your solar panel system. These options can offer competitive interest rates and flexible repayment terms, allowing you to leverage your home's value to invest in renewable energy.

Before choosing a financing program for your solar panel system, it's essential to compare the terms, interest rates, and incentives offered by different providers. Make sure to consider your budget, energy goals, and long-term savings potential when making a decision. Consulting with a solar energy expert can also help you navigate the various financing options available and find the best fit for your needs.

In the vast world of solar panel financing, choosing the right plan for your system can be a daunting task. However, fear not! With a few tips and tricks up your sleeve, you can navigate through the options and find the perfect fit for your needs. Here are some key considerations to keep in mind when selecting a financing plan for your solar panel system:

1. **Assess Your Financial Situation**: Before diving into the world of solar panel financing, take a close look at your financial standing. Consider your budget, credit score, and existing debts. This will help you determine the type of financing that best suits your circumstances.

2. **Compare Different Financing Programs**: Research and compare the various financing programs available in the market. From solar loans to solar leases, each option comes with its own set of pros and cons. Make sure to evaluate the terms, interest rates, and repayment schedules of each program before making a decision.

3. **Look for Incentives and Rebates**: Many states, including Florida, offer incentives and rebates for installing solar panels. These financial perks can significantly reduce the overall cost of your system. Make sure to explore all available incentives and factor them into your financing plan.

4. **Consider Long-Term Savings**: While the upfront cost of solar panel installation may seem daunting, it's essential to consider the long-term savings. Solar panels can significantly reduce your electricity bills over time, making them a worthwhile investment. When choosing a financing plan, think about how the savings from your solar panels will offset the monthly payments.

5. **Seek Expert Advice**: If you're feeling overwhelmed by the plethora of financing options, don't hesitate to seek expert advice. Solar panel installers and financial advisors can provide valuable insights and help you navigate through the complexities of solar panel financing.

6. **Read the Fine Print**: Before signing on the dotted line, make sure to carefully read and understand the terms and conditions of your financing agreement. Pay attention to details such as interest rates, repayment schedules, and any hidden fees. It's crucial to be fully informed before committing to a financing plan.

By keeping these tips in mind, you can choose the right financing plan for your solar panel system with confidence. Remember, investing in solar panels is not just about saving money – it's also about contributing to a greener and more sustainable future for our planet. So, go ahead, explore your options, and embark on your journey towards a solar-powered home!

Steps to Take to Secure Solar Panel Financing

So, you've decided to take the leap and invest in solar panels for your home in Tampa. Congratulations on making a smart choice for your wallet and the environment! Now comes the next important step: securing financing for your solar panel system. Here are some practical steps to help you navigate the process smoothly and efficiently:

1. **Research**: Start by researching different financing options available for solar panels. There are various programs, loans, leases, and incentives that can help you cover the upfront costs of installation. Look into federal and state incentives, utility rebates, and financing plans offered by solar companies.

2. **Assess Your Budget**: Take a close look at your budget and determine how much you can afford to allocate towards solar panel financing. Consider your monthly expenses, income, and savings to figure out a comfortable payment plan that fits your financial situation.

3. **Compare Options**: Once you have a good understanding of the financing programs available, compare them side by side. Look at interest rates, repayment terms, incentives, and any additional fees associated with each option. Choose a plan that offers the best value and aligns with your financial goals.

4. **Get Multiple Quotes**: Reach out to several solar panel installation companies in Tampa and get quotes for your project. Compare the costs, services offered, warranties, and financing options provided by each company. Make sure to ask about any available financing plans or assistance they can offer.

5. **Consult with Experts**: Consider consulting with solar energy experts or financial advisors to get personalized advice on the best financing option for your specific needs. They can help you understand the long-term benefits of investing in solar panels and guide you towards a sustainable financial plan.

6. **Apply for Financing**: Once you've done your research, assessed your budget, compared options, and received multiple quotes, it's time to apply for financing. Fill out the necessary paperwork, provide any required documentation, and wait for approval from the financing institution.

7. **Monitor Progress**: Keep track of the progress of your financing application and stay in touch with the solar panel installation company throughout the process. Be proactive in following up on any additional requirements or updates needed to secure your financing.

By following these steps and being diligent in your research and decision-making process, you can secure the right financing for your solar panel system in Tampa. Remember, investing in solar panels is not just about saving money in the long run; it's also about making a positive impact on the environment and reducing your carbon footprint. So, take the necessary steps to secure financing and start enjoying the benefits of clean, renewable energy for your home.

Common Misconceptions About Solar Panel Financing

When it comes to solar panel financing, there are several misconceptions that often deter homeowners from making the switch to renewable energy. Let's debunk some of these myths and set the record straight!

- Myth #1: Solar panels are too expensive.

- Myth #2: Solar panel financing is complicated.

- Myth #3: Solar panels are not worth the investment.

- Myth #4: Solar panels only work in sunny climates.

- Myth #5: Solar panel financing is only for wealthy homeowners.

While the initial cost of installing solar panels may seem daunting, there are numerous financing options available that can make it affordable for homeowners. From solar loans to leasing programs, there's a solution for every budget.

Contrary to popular belief, securing financing for solar panels is actually quite straightforward. Many solar companies offer assistance with the process, guiding you through each step to make it as easy as possible for you.

On the contrary, investing in solar panels can actually save you money in the long run. With reduced energy bills and potential tax incentives, your solar panel system can pay for itself over time while also increasing the value of your home.

While it's true that solar panels perform best in sunny locations, they can still generate power on cloudy days. Modern solar technology is efficient enough to harness energy even in less-than-ideal weather conditions, making them a viable option for homeowners in various climates.

Financing options for solar panels are designed to be accessible to homeowners of all income levels. Whether you opt for a solar loan, lease, or power purchase agreement, there's a solution that can fit your financial situation.

By debunking these common misconceptions, you can see that solar panel financing is a practical and affordable option for homeowners looking to make the switch to renewable energy. Don't let these myths hold you back from taking advantage of the benefits that solar panels can offer!

Solar Panel Financing Can Save You Money in the Long Run

Are you considering making the switch to solar energy but worried about the initial investment? Don't let the upfront cost deter you from reaping the long-term benefits of solar panels. Financing your solar panel system can actually save you money in the long run, making it a smart financial decision for your home.

Here's how solar panel financing can help you save money over time:

1. **Reduced Energy Bills**: One of the most significant ways solar panel financing can save you money is by reducing your monthly energy bills. By generating your own electricity from the sun, you can significantly lower or even eliminate your reliance on traditional energy sources. This means lower electricity bills every month, putting more money back in your pocket.

2. **Tax Incentives and Rebates**: When you finance your solar panel system, you may be eligible for various tax incentives and rebates offered by the government. These financial incentives can help offset the cost of your system, making it more affordable upfront. Additionally, some financing programs offer competitive interest rates, further reducing your overall expenses.

3. **Increased Home Value**: Installing a solar panel system can increase the value of your home. Studies have shown that homes with solar panels sell for more than those without, making it a smart investment for the future. If you decide to sell your home down the road, you can recoup the cost of your solar panel system and potentially make a profit.

4. **Energy Independence**: By generating your own clean energy, you are less reliant on grid electricity, which is subject to price fluctuations. With solar panels, you can protect yourself from rising energy costs and have greater control over your electricity expenses. This independence can lead to significant savings over the years.

5. **Environmental Benefits**: Beyond the financial savings, investing in solar panels also has environmental benefits. By reducing your carbon footprint and reliance on fossil fuels, you are contributing to a cleaner, more sustainable future for our planet. Knowing that you are making a positive impact on the environment can be priceless.

In conclusion, solar panel financing is not just a way to go green; it's also a smart financial move that can save you money in the long run. By taking advantage of tax incentives, reducing your energy bills, increasing your home value, and achieving energy independence, solar panels can pay for themselves over time. If you're considering financing your solar panel system, consult with a reputable solar provider to explore your options and start saving money today.