Qualifying for the Solar Tax Credit in Tampa

So, you're thinking about going solar in Tampa? That's fantastic news! Not only will you be reducing your carbon footprint and saving money on your energy bills, but you may also be eligible for the Federal Solar Tax Credit. But what exactly is the Federal Solar Tax Credit, and how can you qualify for it in Tampa?

The Federal Solar Tax Credit, also known as the Investment Tax Credit (ITC), is a federal incentive that allows homeowners to deduct a portion of the cost of installing a solar energy system from their federal taxes. This tax credit has been a game-changer for many homeowners looking to make the switch to solar power, as it can significantly reduce the upfront cost of installation.

To qualify for the Solar Tax Credit in Tampa, there are a few key requirements you need to meet. First and foremost, you must own your home and have the solar panels installed on it. Additionally, the solar panels must be installed and operational before the end of the tax year in which you are claiming the credit. It's important to note that leased solar panels do not qualify for the tax credit, so be sure to purchase your system outright.

In Tampa, the Federal Solar Tax Credit allows you to claim 26% of the total cost of your solar energy system as a tax credit for the year 2020 and 2021. This percentage will decrease to 22% in 2023, and then the tax credit is set to expire for residential installations. Therefore, it's crucial to take advantage of this incentive while it's still available.

Now that you understand what the Federal Solar Tax Credit is and how to qualify for it in Tampa, you're one step closer to reaping the benefits of making the switch to solar energy. Stay tuned for the next section on calculating your tax credit savings, where we'll break down how much you can save by going solar in Tampa.

Qualifying for the Solar Tax Credit in Tampa

So, you're considering making the switch to solar energy in your Tampa home – that's fantastic! Not only will you be helping the environment, but you can also benefit from financial incentives like the Federal Solar Tax Credit. But how do you qualify for this tax credit? Let's break it down.

First things first, to be eligible for the Federal Solar Tax Credit, you must own your solar panel system. If you're leasing the system, unfortunately, you won't qualify for the credit. So, make sure you're the proud owner of those shiny solar panels on your roof.

Next, the solar panels must be installed and operational in the tax year you're claiming the credit for. This means that if you install your solar panels in 2022, you can claim the credit when you file your taxes for that year. It's essential to keep all your installation and purchase receipts handy for documentation.

Now, let's talk about the requirements for the solar panels themselves. The panels must be new and not previously used. They must also be certified by the appropriate authorities, like the Florida Solar Energy Center Certification or the California Energy Commission. Ensuring your panels meet these criteria will guarantee your eligibility for the tax credit.

Additionally, the solar panels must be installed in your primary or secondary residence, meaning you can't claim the credit for panels installed in a rental property or vacation home. So, if you're looking to install solar panels in your Tampa home, rest assured that you can take advantage of this fantastic incentive.

It's important to note that the Federal Solar Tax Credit is a percentage of the total cost of your solar panel system, including installation. As of now, the tax credit is set at 26% but is set to decrease in the coming years. So, the sooner you go solar, the more significant the credit you'll receive.

Remember, tax laws can be complex and subject to change, so it's always a good idea to consult with a tax professional or a solar energy expert to ensure you meet all the requirements for the Federal Solar Tax Credit.

In conclusion, qualifying for the Solar Tax Credit in Tampa is a straightforward process as long as you own your solar panel system, have them installed in your primary or secondary residence, and meet all the necessary certification requirements. By taking advantage of this incentive, you can enjoy both environmental and financial benefits from your switch to solar energy.

In the exciting journey of transitioning to solar energy in your home, one of the most rewarding aspects is undoubtedly the Federal Solar Tax Credit. This incentive allows you to save a significant amount of money on your solar panel installation, making the switch to clean, renewable energy even more enticing.

So, how can you calculate your tax credit savings and make the most of this opportunity? Let's break it down in a simple and friendly manner:

1. Understanding the Solar Tax Credit Calculation: The Federal Solar Tax Credit, also known as the Investment Tax Credit (ITC), allows you to deduct a percentage of the cost of installing a solar energy system from your federal taxes. Currently, the tax credit covers 26% of the total cost of your solar panel system. For example, if your solar panel installation costs $10,000, you can receive a tax credit of $2,600 (26% of $10,000).

2. Maximizing Your Savings: To ensure you receive the maximum tax credit benefits, it's important to make sure your solar panel system meets all the necessary requirements. This includes using a qualified solar panel installer, purchasing eligible equipment, and owning the solar panels (not leasing them).

3. Claiming Your Tax Credit: When filing your taxes, you can claim the Federal Solar Tax Credit using IRS Form 5695. Simply enter the total cost of your solar panel system and calculate 26% of that amount to determine your tax credit savings. Make sure to keep all receipts and documentation related to your solar panel installation for proof.

4. Rolling Over Tax Credit: If your tax liability is not enough to utilize the full tax credit in the year of installation, you can carry over the remaining amount to the following year. This flexibility allows you to maximize your savings over time.

5. Consulting a Tax Professional: If you have any doubts or questions regarding the Federal Solar Tax Credit, it's always a good idea to consult with a tax professional. They can provide personalized advice based on your specific financial situation and help you navigate the tax credit process smoothly.

By understanding how to calculate your tax credit savings, you can make informed decisions when investing in a solar panel system for your home. Not only will you reduce your carbon footprint and lower your energy bills, but you'll also enjoy significant financial benefits through the Federal Solar Tax Credit.

Remember, the Federal Solar Tax Credit is set to decrease in the coming years, so now is the perfect time to take advantage of this opportunity and make the switch to solar energy. Happy savings and happy solar panel installation!

Additional Incentives for Installing Solar Panels in Tampa

So, you're considering installing solar panels in your Tampa home to take advantage of the Federal Solar Tax Credit. That's a wise decision not only for the environment but also for your wallet. But did you know there are additional incentives available that can sweeten the deal even further? Let's dive into some of these extra perks that can make your solar panel investment even more rewarding:

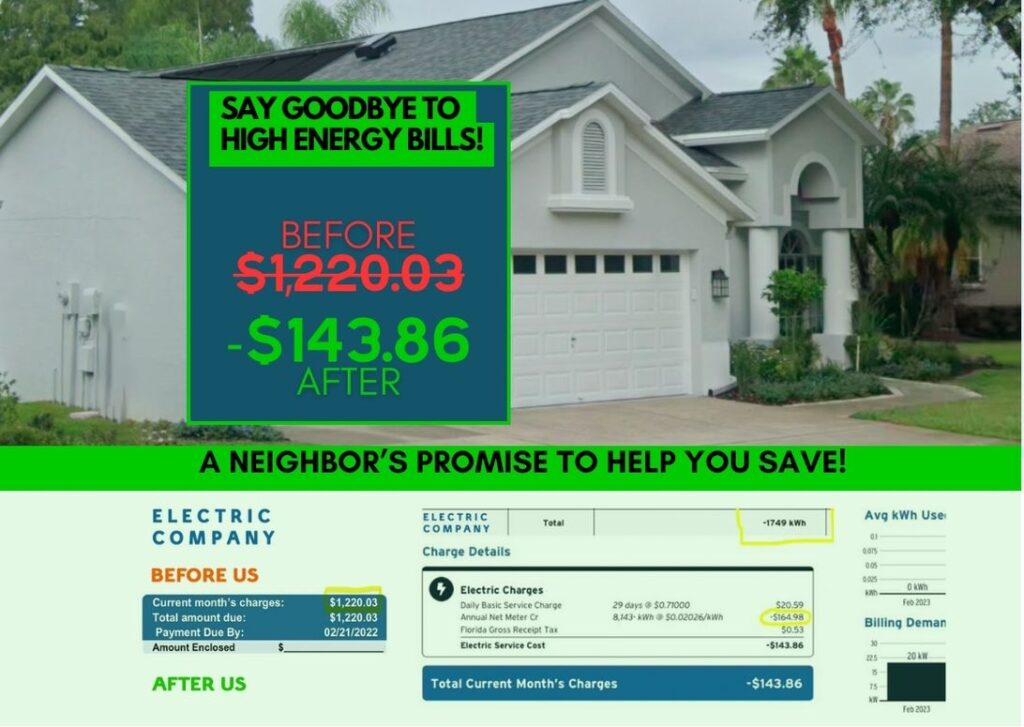

1. Net Metering: Net metering is a program that allows you to sell excess electricity generated by your solar panels back to the grid. In Tampa, this can result in credits on your electricity bill, further reducing your costs. It's a fantastic way to maximize the benefits of your solar panels and potentially even earn some extra money.

2. Property Tax Exemption: Installing solar panels can increase the value of your home. Fortunately, in Tampa, you won't be penalized for this increase in property value. You can enjoy a property tax exemption on the added value of your solar panels, saving you money in the long run.

3. Sales Tax Exemption: When you purchase solar panels in Tampa, you can take advantage of a sales tax exemption. This means you won't have to pay sales tax on your solar panel system, leading to significant savings on your initial investment.

4. Local Utility Rebates: Some local utility companies in Tampa offer rebates or incentives for installing solar panels. These can vary by provider, so it's worth checking with your utility company to see if there are any additional savings available to you.

5. Financing Programs: Many financing programs specifically tailored for solar panel installations are available in Tampa. These programs can help make the upfront costs more manageable and allow you to start saving on your energy bills right away.

By combining these additional incentives with the Federal Solar Tax Credit, you can significantly reduce the overall cost of installing solar panels in your Tampa home. Not only will you be saving money in the long run on your energy bills, but you'll also be contributing to a cleaner environment and increasing the value of your property.

Remember, it's essential to do your research and take advantage of all the incentives available to you. Every little bit helps when it comes to making the switch to solar energy. So, don't hesitate to explore all the options and make the most of the benefits that installing solar panels in Tampa has to offer.

Investing in solar panels is not just a smart financial decision; it's a step towards a more sustainable future. With the right incentives and programs in place, going solar in Tampa is easier and more beneficial than ever before. So, why wait? Start reaping the rewards of solar energy today!

Tips for Maximizing Your Tax Credit Benefits

Are you considering installing solar panels on your home in Tampa? If so, you're making a smart choice not only for the environment but also for your wallet! To help you make the most of the Federal Solar Tax Credit, here are some tips to maximize your benefits:

1. Plan Ahead: The Federal Solar Tax Credit is set to decrease in the coming years. To take full advantage of the current 26% tax credit, it's essential to start your solar panel installation as soon as possible. Don't wait until the last minute to make the switch to solar!

2. Invest in Energy Efficiency: Before installing solar panels, make sure your home is as energy-efficient as possible. This could include upgrading insulation, sealing drafts, and replacing old appliances with energy-efficient models. By reducing your overall energy consumption, you can maximize the impact of your solar panels and increase your tax credit savings.

3. Choose the Right Size System: When deciding on the size of your solar panel system, consider both your current energy needs and future goals. A system that is too small may not generate enough energy to offset your electricity bills, while a system that is too large could be a costly investment. Work with a professional solar panel installer to determine the optimal size for your home.

4. Keep Detailed Records: To claim the Federal Solar Tax Credit, you'll need to provide documentation of your solar panel installation costs. Keep detailed records of all expenses, including receipts, invoices, and contracts. This will make it easier to accurately calculate your tax credit savings when filing your taxes.

5. Stay Informed: Tax laws and incentives can change, so it's important to stay informed about updates to the Federal Solar Tax Credit. Follow reputable sources, attend informational seminars, and consult with tax professionals to ensure you're taking full advantage of available incentives.

6. Explore Additional Incentives: In addition to the Federal Solar Tax Credit, there may be other incentives available at the state or local level. Research programs offered by the state of Florida, utility companies, and local governments to see if you qualify for additional savings on your solar panel installation.

7. Work with a Professional Installer: Installing solar panels is a significant investment, so it's essential to work with a reputable and experienced solar panel installer. Look for certified professionals with a track record of successful installations in the Tampa area. They can help you navigate the process, maximize your tax credit benefits, and ensure your system is installed correctly for optimal performance.

By following these tips, you can make the most of the Federal Solar Tax Credit and enjoy the long-term benefits of solar energy. Start your journey to a more sustainable and cost-effective home today!

Hiring a Professional Solar Panel Installer in Tampa

When it comes to installing solar panels in your home in Tampa, choosing the right professional installer is crucial. While some may consider a DIY approach, hiring a professional can ensure that your solar panel system is installed correctly and efficiently, maximizing its performance and longevity. Here are some tips on finding and hiring the best solar panel installer in Tampa:

1. Research and Credentials: Start by researching reputable solar panel installers in Tampa. Look for companies with experience, positive reviews, and proper licensing and certifications. A trustworthy installer should be able to provide proof of their qualifications and past installations.

2. Get Multiple Quotes: Don't settle for the first installer you come across. Get quotes from at least three different companies to compare prices, services, and warranties. Remember, the cheapest option may not always be the best one in the long run.

3. Ask for References: Request references from past customers to get an idea of the installer's track record. A reliable installer should have no problem providing you with references who can vouch for their workmanship and customer service.

4. Check for Manufacturer Partnerships: Some installers work closely with specific solar panel manufacturers, which can be a good sign of quality and expertise. Look for installers who are certified partners with reputable solar panel brands.

5. In-House Installation Team: It's best to hire a company with an in-house team of installers rather than subcontracting the work. This ensures better quality control and accountability throughout the installation process.

6. Warranty and Maintenance: Inquire about the warranties offered by the installer, both for the solar panels and the installation work. A reliable installer should provide comprehensive warranties and offer maintenance services to keep your system running smoothly.

7. Financing Options: Ask about financing options and any available incentives or rebates that the installer can help you access. A professional installer should be knowledgeable about federal and state incentives that can further reduce the cost of your solar panel system.

By following these tips and doing your due diligence in selecting a professional solar panel installer in Tampa, you can rest assured that your investment in solar energy will be well worth it. A well-installed and maintained solar panel system can provide you with clean, renewable energy for years to come, saving you money on your electricity bills and reducing your carbon footprint. So, take the time to find the right installer for your needs and enjoy the benefits of solar power in your home.

Staying up-to-date with the latest information on solar tax credits in Tampa is crucial for homeowners looking to make the switch to renewable energy. With various changes in legislation and updates in incentives, it's essential to have reliable resources to guide you through the process.

Here are some valuable sources to keep you informed:

1. Local Government Websites: Check the official websites of the City of Tampa and Hillsborough County for any updates on solar incentives and tax credits. They often provide detailed information on available programs and resources for residents interested in solar energy.

2. Florida Solar Energy Industries Association (FlaSEIA): FlaSEIA is a non-profit organization dedicated to promoting the growth of solar energy in Florida. They offer valuable insights into the solar industry in the state, including information on tax credits, incentives, and rebates available to homeowners.

3. Solar Energy Industries Association (SEIA): SEIA is a national trade association that represents the solar industry in the United States. They provide comprehensive resources on federal and state solar policies, including tax credits and incentives. Keeping an eye on their website can help you stay informed on the latest developments in the solar industry.

4. EnergySage: EnergySage is an online marketplace that connects solar shoppers with reputable solar installers. They also provide valuable resources on solar incentives and tax credits specific to your location. By using their platform, you can easily compare solar quotes and find the best solar solution for your home.

5. Solar Power Rocks: Solar Power Rocks is a website that offers state-specific information on solar incentives and tax credits. They provide a comprehensive overview of the savings you can expect from installing solar panels in Tampa, including the federal solar tax credit and other local incentives.

6. Consult with a Solar Expert: One of the best ways to stay informed on solar tax credits in Tampa is to consult with a professional solar installer. They have up-to-date knowledge on the latest incentives and can help you navigate the complex landscape of solar rebates and credits.

By staying informed through these reliable resources, you can make informed decisions about installing solar panels in your home and maximize your savings through tax credits and incentives. Remember, the solar industry is constantly evolving, so it's essential to stay informed and take advantage of the benefits available to you as a homeowner in Tampa.